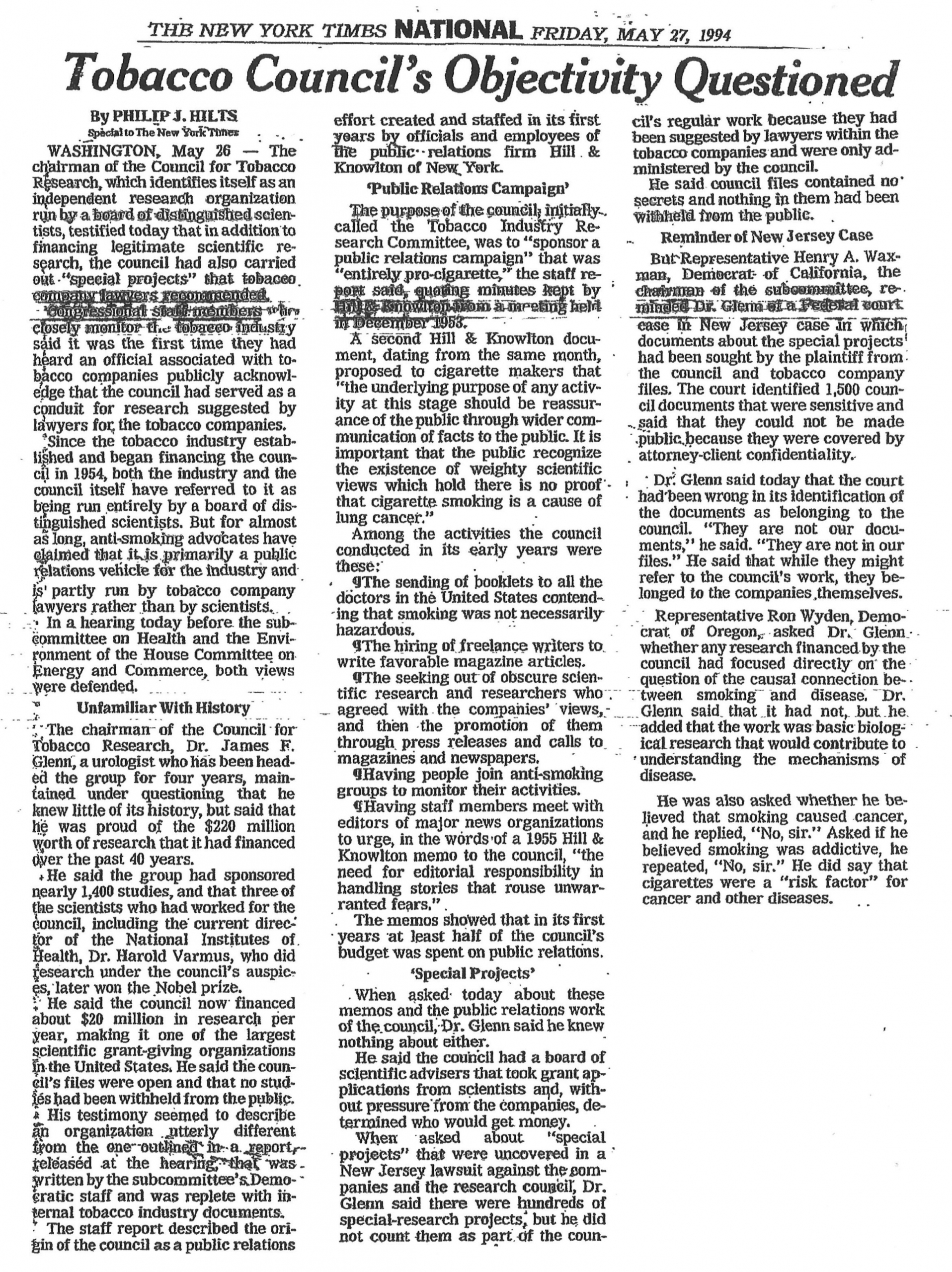

“THE COUNCIL FOR TOBACCO RESEARCH — U.S.A., INC. (11 pages)

January 23, 1985

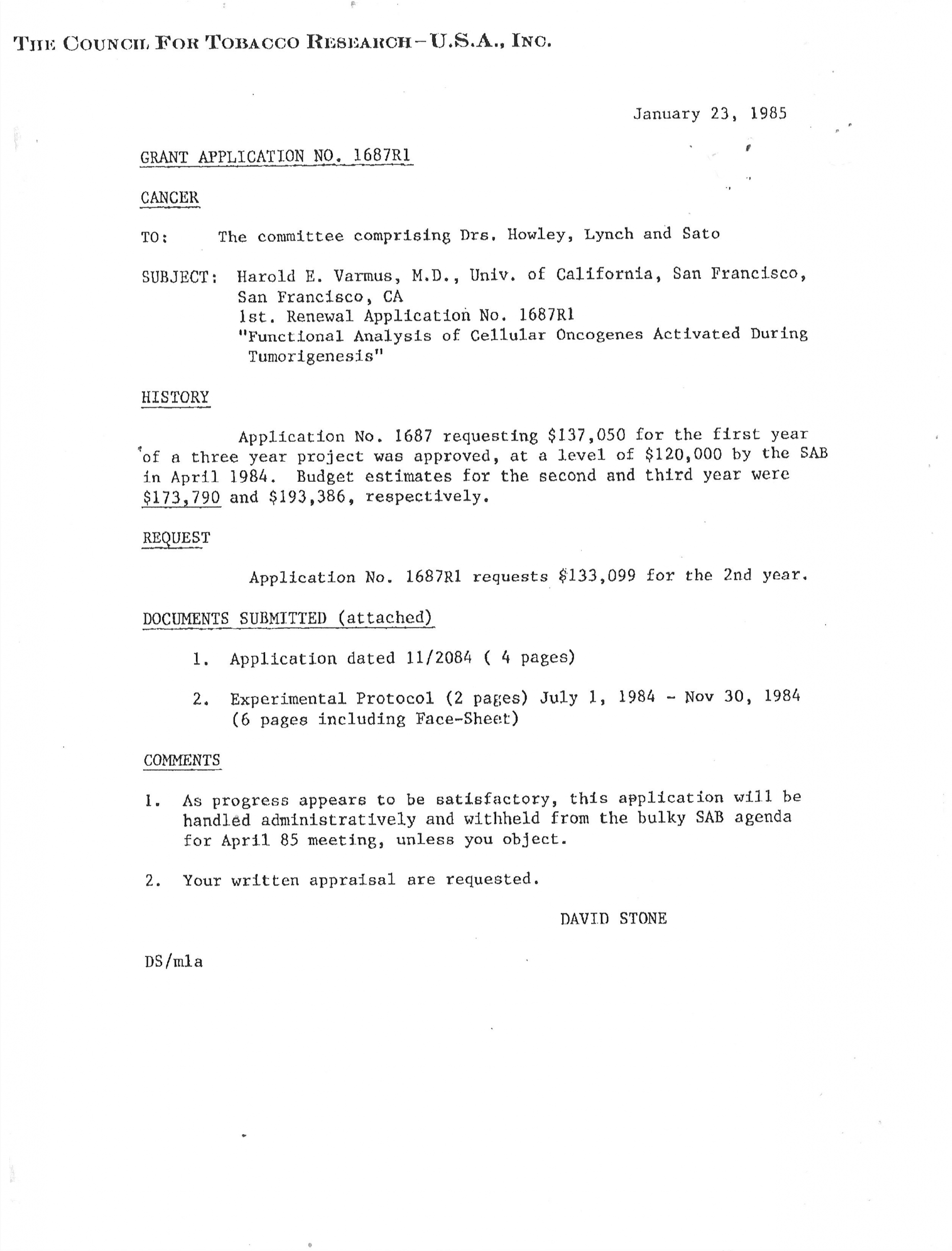

GRANT APPLICATION NO. 1687R1

CANCER

TO: The committee comprising Drs. Howley, Lynch and Sato

SUBJECT: Harold K. Varmus, M.D., Univ. Of California, San Francisco, San Francisco, CA

1st Renewal Application N. 1687R1

“Functional Analysis of Cellular Oncogenes Activated During Tumorigenesis’

HISTORY

Application No. 1687 requesting $137,050 for the first of a three year project was approved, at a level of $120,000 by the SAB in April 1984. Budget estimates for the second and third year were $173,790 and $193,386, respectively.

REQUEST

Application No. 1687R1 requests $133,099 for the 2nd year…”

Identified by Donald Shopland in the Truth Tobacco Industry Documents, February 26, 2025

https://www.industrydocuments.ucsf.edu/tobacco/docs/#id=lmkc0070

Other documents included here: 1. A letter from Dr. Varmus to The Council for Tobacco Research (CTR) on April 20, 1971, accepting an invitation to attend CTR’s conference, “Alterations in Gene Expression Carcinogenesis.”

2.A letter from the president of CTR to Dr. Varmus on May 7, 1985, informing him that he has been awarded a 1-year renewal grant of $133,099.

3.A letter from Dr. Varmus to the Research Director of CTR describing the basis of his request for CTR funding for at least 3 years at $125,000 a year.

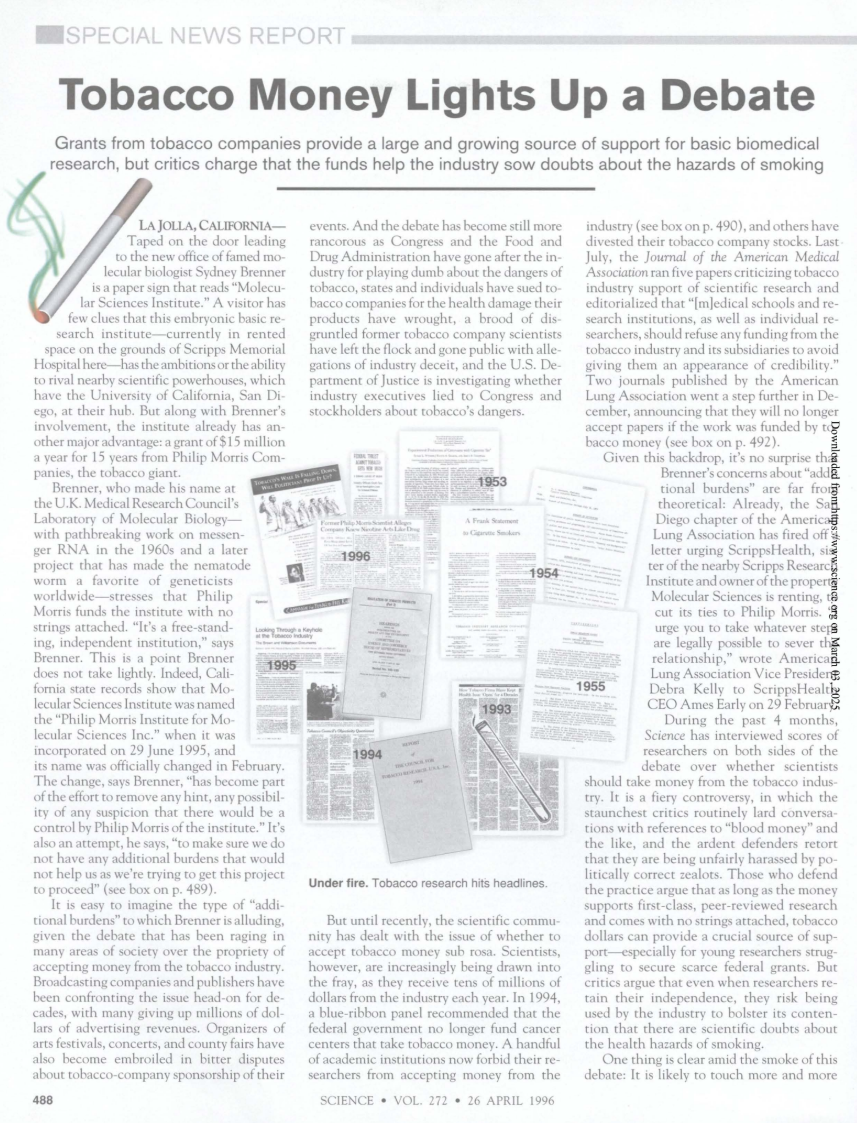

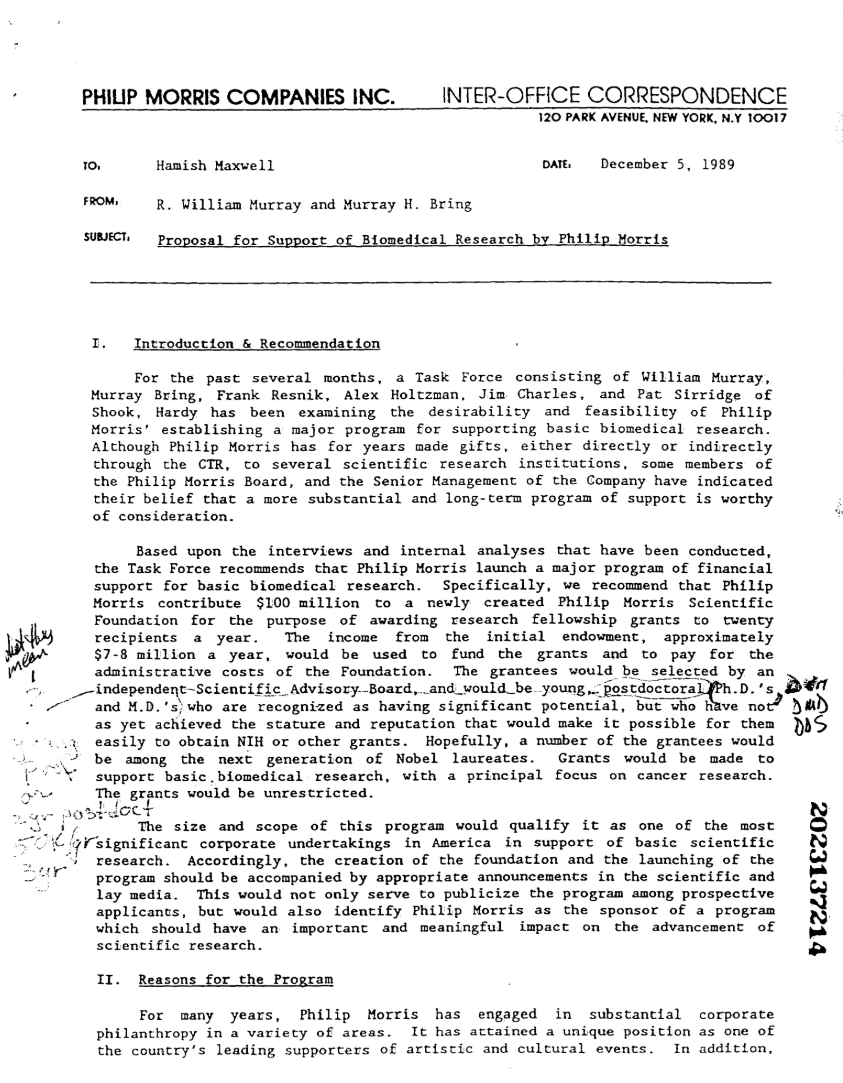

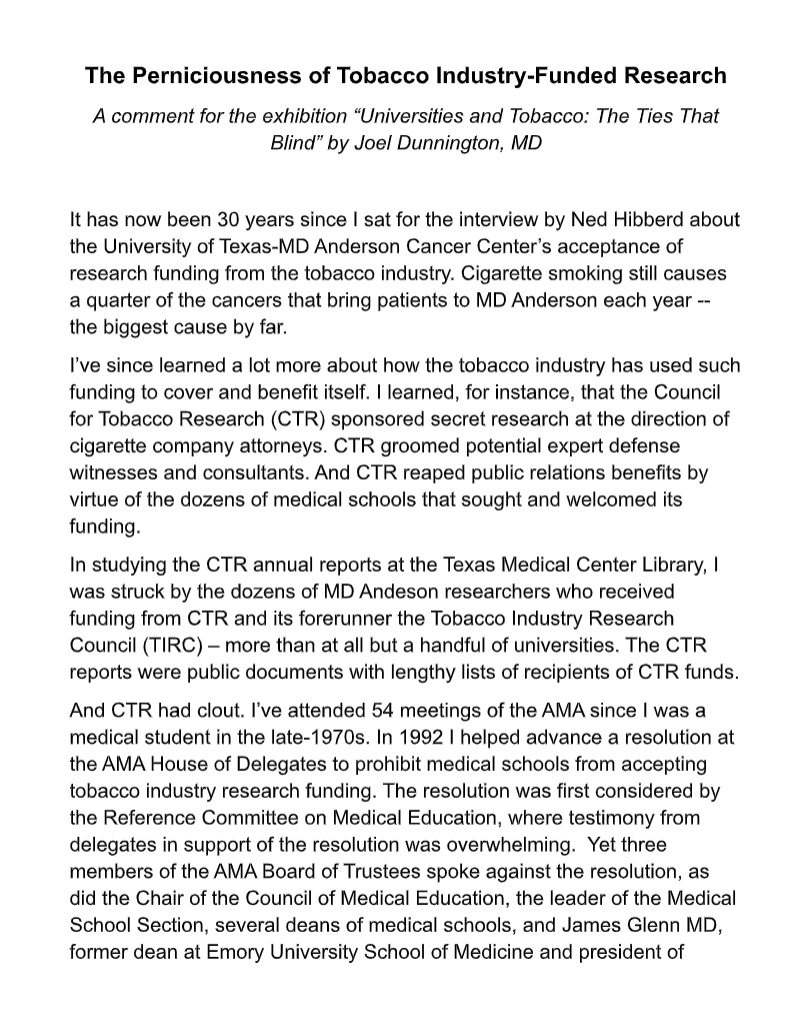

4.A letter from James S. Glenn, MD, CEO of CTR to James S. Todd, MD, executive vice president of the American Medical Association (AMA) on February 1, 1995, responding to “your misleading portrayal of the Council for Tobacco Research-U.S.A., Inc. as a public relations pawn of the tobacco industry” and citing the name of one scientist, “Dr. Harold Varmus, Director of the National Institutes of Health, [who] “incidentally, is a former recipient of CTR grant which supported his early investigations, and he is one of three CTR grantees who have gone on to win the Nobel Prize in Medicine.”

5.An announcement in October 1998 by the Scientific Advisory Board of CTR congratulating Drs. Louis J. Ignarro and Ferid Murad for receiving the 1998 Nobel Prize in Medicine or Physiology and noting their having received financial support from CTR, “as have three other Nobel prize winner,” including Dr. Varmus. A bar graph shows that there were 255 “Active CTR grantees and scholars in 1998.

Curator’s Note: On November 23, 1998, the Council for Tobacco Research was dissolved as part of the Master Settlement Agreement (MSA) between the tobacco industry and the state attorneys general, who had sued the tobacco industry claiming that the cigarette manufacturers were responsible for the public health burden caused by cigarette smoking and should therefore reimburse the states for the associated medical expenses paid by Medicaid.

Donald Shopland was a member of the staff of the Advisory Committee to the Surgeon General, which produced the landmark report on smoking and health in 1964. Over a career in the Public Health Service that spanned five decades, he served as an editor of 17 reports of the Surgeon General on smoking and health (and a reviewer on all 34 reports issued from 1967 to 2014), interim director of the Office on Smoking and Health, and advisor on smoking and health at the National Cancer Institute. Interviewed for this exhibition on February 27, 2025, Shopland expressed his dismay over researchers who sought funding from the tobacco industry, even as the industry’s Council for Tobacco Research was downplaying cigarette smoking as the leading avoidable cause of cancer:

“One can perhaps understand medical schools taking tobacco money in the years before the release of the Surgeon General’s report in 1964 and maybe also in the first few years of the report in order to continue confirming its conclusions about the dire health consequences of smoking. But for this to still be occurring upwards of 50 years later is just wrong on so many levels.

“How sad, too, that in 1980, Dr. Harold Varmus, by then a mid-career professor at the University of California at San Francisco (who would go on to receive the Nobel Prize in Medicine in 1989 for his contributions to the field of retroviruses and oncogenes, to serve as director of the National institutes of Health from 1993 to 1999, and to head the National Cancer Institute from 2010 to 2015) apparently had no scruples about applying for and accepting tobacco industry funding.

“I think a better subtitle for this exhibition would be ‘Blood Money.'”

Curator’s Note: On March 2, 2025, and again on March 19, the Center for the Study of Tobacco and Society sent a lengthy email to Dr. Varmus at Weil Cornell Medicine, where he is listed as Lewis Thomas University Professor of Medicine, requesting a comment for this exhibition about his having sought and received several hundred thousand dollars in funding from The Council for Tobacco Research in the 1980s. If Dr. Varmus submits a comment, then it will be added to the exhibition.