For nearly four decades from the mid-1920s to the early-1960s, the Metropolitan Life Insurance Company conducted a vigorous health promotion campaign in popular magazines to educate the public about preventing or reducing the risk for numerous diseases, including cancers, heart disease, diabetes, arthritis, obesity, anxiety, pneumonia, tuberculosis, and even syphilis. Yet in spite of the growing evidence implicating cigarette smoking as a major cause of the rise in lung cancer — and actuarial evidence by the 1950s of a significant difference in longevity between smokers and non-smokers — there was no mention of smoking in any of the company’s frequent ads and pamphlets on the facts about cancer. Not until after publication of the Surgeon General’s Report on smoking and health in January 1964 did the insurance industry provide an incentive to lower the cost of life insurance premiums, led by State Mutual of Massachusetts, which offered the first nationally promoted non-smoker’s discount. This exhibition features health education advertisements and pamphlets by the Metropolitan Life Insurance Company; pioneering advertisements by State Mutual for a non-smoker’s discount on life insurance; fire insurance advertisements in which cigarettes are implicated as a major problem; and health insurance advertisements in which, like those for life insurance, the leading avoidable risk factor is unmentioned.

In 1863 the National Union Life and Limb Insurance Company was founded in New York City to provide disability coverage for Civil War sailors and soldiers. The firm was renamed the Metropolitan Life Insurance Company five years later to reflect its new focus. In 1915, as the nation’s largest life insurer, it became a mutual company for the benefit of policyholders. In 2000, newly incorporated as MetLife, the company became publicly traded on the New York Stock Exchange. Since 2016, Metropolitan Life Insurance Company has been part of a subsidiary of MetLife, Brighthouse Financial (assets of $230 billion). Today MetLife is the largest global provider of insurance, annuities, and employee benefit programs. It serves 90 million customers in more than 60 countries. From the company’s website: “MetLife’s insights and expertise provide a wide range of benefit solutions. From health, auto, legal, life, and so much more.”*

Click on each image in the exhibition to enlarge.

Educational advertisements about cancer

“Cancer — Ostriches”

Advertisement by the Metropolitan Life Insurance Company

The National Geographic Magazine

1927

“Because the nature and origin of cancer are largely shrouded in mystery, quacks and crooked institutions reap a cruel harvest. They prey upon the fear and ignorance of those who do not know the facts concerning cancer. They are often successful in making people believe that they have cancer when they have not.

“Later, with a great flourish, they boast of their ‘cures’…Beware of those who advertise cancer cures.

“An annual physical examination by your family physician, or the expert to whom he sends you, may be the means of detecting cancer in its early stages. Do not neglect it…”

“What about Cancer?”

Advertisement by the Metropolitan Life Insurance Company

The National Geographic Magazine

Circa 1928

“There is good news about cancer. In many instances it can be prevented and if treated in its early stages it can be eradicated…

“The greatest scientists of the world, though they have searched for years and are still searching, have not found a serum to prevent cancer or drugs to cure it. The great victories have come from surgery, X-rays or radium.

“Spread the good news about cancer – how it can be recognized in its early stages – how to get rid of it. Help to save lives.

“Almost as many people over 40 die of cancer as of pneumonia, tuberculosis and typhoid fever combined. If – and when – cancer is successfully brought under control, the cost of life insurance will be reduced…”

“Most of the 5000 people who died last year from one particular form of cancer could have been saved if they had been warned in time of their impending danger – and had acted without delay”

Advertisement by the Metropolitan Life Insurance Company

The American Magazine

August 1932

“LAST year in the United States alone there were more than 5,000 deaths caused by rectal cancer. Had these cancers been discovered in their early stages, a large majority could have been operated upon successfully. Almost all of then could have been found by competent physicians making thorough physical examinations…

“The United States Army and Navy Medical Divisions, leading newspapers, magazines, the foremost doctors and health officials all over the country urge complete, periodic physical check-ups. It would be impossible to estimate correctly the amount of suffering such examinations prevent and the years of life they add…”

“Many Cancers are Curable

Keep Healthy – Be Examined Regularly”

Advertisement by the Metropolitan Life Insurance Company

Scribner’s Magazine

January 1937

“Medical experts state that many cancers can be cured if discovered and treated in time – but time is the all-important element.

“Cancer in its early stages can often be destroyed by radium and X-rays, or removed by surgery. An increasing number of cases are being discovered early and the technique in successfully removing or destroying these cancers is steadily advancing…

“Physicians warn against neglected conditions which are known to precede the onset of cancer – lumps, unusual discharges, wounds that will not heal, moles and warts that change in size and color, or other abnormal conditions. Continued irritation of any part of the body is often the beginning of trouble…

”…A complete physical check up which shows there is nothing wrong is a very comforting assurance. Thorough and competent periodic physical examinations may help doctors to discover cases of cancer while there is still time for successful treatment…”

“DISCOVERED IN TIME – MOUTH CANCERS ARE CURABLE!”

Advertisement by the Metropolitan Life Insurance Company

The National Geographic Magazine

1939

“Mouth cleanliness is especially important in the prevention of cancer fatalities. Bad teeth should be cared for or removed. Jagged edges of teeth should be smoothed. Dental plates and bridges should fit comfortably. Some persons have a mouth condition known as leukoplakia – ‘white spot disease’ – which, if untreated, may develop later into cancer. In these cases particularly the excessive use of tobacco and sharp condiments should be avoided…”

“A Skin Blemish

May be a Cancer in the making”

Advertisement by the Metropolitan Life Insurance Company

TIME Magazine

September 26, 1938

“Don’t be a self-appointed quack! Let moles, warts and other blemishes alone. Ask your physician whether or not removal is advisable…

“Skin cancers are the easiest of all to detect and cure, yet they kill more than 3000 persons every year in the United States. If you have the slightest suspicion that a mole or other skin condition may be developing in any unusual way, see your doctor at once. Most skin cancers, given prompt and skilful treatment, can be cured without deformity.

“Send for the Metropolitan free booklet ‘Cancer.’ Address Booklet Department 1038-Q.”

“THE MOST COMMON FORM OF CANCER

–and what you should know about it”

Advertisement by the Metropolitan Life Insurance Company

The American Magazine

March 1940

“GASTRIC CANCER –STOMACH CANCER – is the most common form that cancer takes. And it causes the largest number of cancer fatalities.

“But … today many sufferers are being relieved by improves treatment and operative technique. With greater frequency, cases are being recognized and treated early, with more promise of success…

“For further information about cancer, send for Metropolitan’s free booklet, ‘A Message of Hope.’”

“’No, it isn’t Cancer –‘”

Advertisement by the Metropolitan Life insurance Company

The National Geographic Magazine

1942

“THIS WOMAN had one of the symptoms often associated with cancer. Again and again she asked herself, ‘Shall I wait and see what happens … or go to the doctor?’ Wisely, she chose the latter course…”

“The conquest of CANCER is progressing”

Advertisement by the Metropolitan Life Insurance Company

The National Geographic Magazine

1947

“Today, more and more people are living to older ages when cancer is most prevalent. Cancer still ranks second among the causes of death, but medical science is continually increasing its knowledge of the disease.

“While specialists say that the best means known for treating cancer is complete removal by surgery, or complete destruction by X-rays or radium rays, experiments with other methods are constantly going forward. Atomic research has provided valuable new materials for laboratory study of cancer cells. Clinical research and intensive studies in chemistry, biology, and physics also give real hope for the future…”

“Can you answer these questions about

CANCER?

Q. Are we winning or losing the war on cancer?

Q. How is medical science attacking cancer?

Q. Has any new ‘sure cure’ for cancer been perfected?

Q. What should everyone do about cancer?

Q. What are cancer’s ‘danger signals’?”

Advertisement by the Metropolitan Life Insurance Company

Collier’s Magazine

September 7, 1946

“What YOU Can Do About Cancer”

Advertisement by the Metropolitan Life Insurance Company

The Saturday Evening Post

1949

“Great strides have been made in diagnosing and treating cancer. While it is still the second major cause of death in the United States, the mortality rates from some forms are declining…

“Present knowledge can be fully utilized only as more people learn the warnings of the disease and come for examination without delay…”

“How you can help conquer CANCER”

Advertisement by the Metropolitan Life Insurance Company

The Saturday Evening Post

1952

“Year after year, the outlook for controlling cancer grows brighter. Scientists are learning more about how and why cancer occurs, and are developing new methods of diagnosis and treatment. In addition, centers for the early detection of cancer are being increased, additional hospitals devoted exclusively to its treatment are opening, and greater numbers of doctors are being trained to combat cancer more effectively than ever before…

“Today, by facing the facts about cancer, overcoming fear of it, and acting promptly when the disease is suspected, cancer may be controlled or cured in many cases…”

“A MESSAGE OF HOPE ABOUT CANCER”

Advertisement by the Metropolitan Life Insurance Company

The National Geographic Magazine

1953

“…Today there is hope for even greater gains in our fight against this disease. This is because medical research is constantly yielding new facts about how and why cancer develops.

“Some recent research findings

“In surgery – major operations can now be performed with are less risk to cancer patients. Largely because of greater surgical skill, the number of patients recovering from cancer of the head, neck, stomach, and uterus has been more than doubled over the past few years.

“In chemotherapy – or treatment with chemicals – encouraging progress is being made. Some chemical substances are now being used which temporarily inhibit the growth of a few types of cancer in human beings.

“In radiology – or X-ray treatment – intensive studies are under way on devices that are not only capable of producing more powerful X-rays, but also offer hope of a more effective use of them…

“Above all, remember that cancer is often cured … and that getting to your doctor early is your greatest contribution toward recovery.”

“‘No, it isn’t CANCER …'”

Advertisement by the Metropolitan Life Insurance Company

TIME Magazine

May 30, 1955

“People are beginning to realize that there is much needless worry about cancer. For example, the American Cancer Society reports that at a typical cancer clinic, where large numbers of people are examined, only about one out of every 125 is found to have cancer.

“Thanks to medical progress, the spirit of hopelessness that once surrounded cancer has been replaced by rising optimism. This is based in part on the increased number of lives now being saved. Records of the American Cancer Society, for instance, show that skin cancer, discovered early and treated promptly and properly, is curable in 85 percent of the cases…

“Cancer still ranks second as a cause of death – but cancer is not hopeless. Even with today’s weapons, we are … according to the American Cancer Society … saving the lives of 70,000 people each year from cancer.”

“Can you answer these questions on CANCER?”

Advertisement by the Metropolitan Life Insurance Company

The National Geographic Magazine

1956

“Does CANCER give early warning signals? …

“Why is early diagnosis so important? …

“Are we gaining in the fight on CANCER? …

“Are there any new ‘sure cures’ for CANCER? …”

“Charting a safer course against CANCER …”

Advertisement by the Metropolitan Life Insurance Company

The National Geographic Magazine

1957

“Just as the pilots of ships are helped to chart safer courses by heeding signals, so, too, have many people been made safe by recognizing warning signals of possible cancer and taking proper action.

“In fact, thousands of people are alive and well today because they knew cancer’s warning signs and were treated in time. For your own protection, you should know the danger signals which are listed here…

“Medical science is now pushing a total attack against cancer … and progress is being made in both cancer diagnosis and treatment. Meantime, you have a responsibility to yourself and others to:

“1. Have periodic health examinations.

“2. Know cancer’s early danger signals.

“3. Get prompt medical care at once if any danger signal appears…”

“TIME IS CANCER’S GREATEST ALLY …”

Advertisement by the Metropolitan Life Insurance Company

Good Housekeeping Magazine

1954

“…Unfortunately, cancer often develops silent without noticeable symptoms. Here too, there is a safeguard – periodic medical examinations. These are particularly important for all men and women who have reached the age of 40 and 35 respectively. The value of these examinations is underscored by the fact that half of all cancers occur in body sites that the doctor can readily examine…”

“Probing the Secrets of Cells …

To advance the fight on CANCER”

Advertisement by the Metropolitan Life Insurance Company

The National Geographic Magazine

Circa 1961

“Discoveries in cytology – the science of cells – have revealed some of the innermost secrets of cells. When scientists finally learn why healthy cells become malignant and how to halt their disorderly growth, they will have the key to cancer.

“Already, the study of cells has given us new weapons against some forms of cancer. In fact, one of the most important advances in recent years is the discovery that one of the leading types of cancer in women can be diagnosed in its very earliest stages…

“Thanks to this test – known as ‘the Pap smear’ or the Papanicolaou test – the type of cancer that it reveals is about 100 percent curable if detected early enough…”

“Progress against …

Cancer

‘the world’s toughest jigsaw puzzle’”

Advertisement by the Metropolitan Life Insurance Company

The National Geographic Magazine

Circa 1961

“Cancer, a disease of almost unbelievable complexity, has been called ‘the world’s toughest jigsaw puzzle.’ Fortunately, more and more pieces of the puzzle are falling into place, so that a clearer picture of cancer is emerging – optimism for its eventual conquest is increasing.

“Many new discoveries have been made about the chemical differences between normal and cancer cells … about the role of viruses in some forms of cancer … about the influence of hormones in the development of the disease … about the body’s innate ability to react or develop immunity against cancerous cells…

“For more information about cancer, write for Metropolitan’s booklet, Facts About Cancer…”

“Cancer … like a small spreading flame … demands prompt action”

Advertisement by the Metropolitan Life Insurance Company

The Reader’s Digest

Circa 1961

“At the first sign of trouble – and cancer often causes early waring symptoms – see your physician right away…

“Since early detection is an important factor in the outcome of cancer, all adults should have periodic health examinations and, between checkups, watch for these seven warnings of cancer:

- Unusual bleeding or discharge.

- A lump of thickening in the breast or elsewhere.

- A sore that does not heal.

- Change in bowel or bladder habits.

- Hoarseness or cough.

- Indigestion or difficulty in swallowing.

- Change in a wart or mole…”

“We don’t know who will die –

But we know how many”

Advertisement by the Metropolitan Life Insurance Company

TIME Magazine

July 11, 1938

“Did you ever hear of a mortality table? It is a table that shows the number of people in any given age group who have died each year.

“Mortality tables are based on past experience and become measuring rules for the future. Many mortality tables are available. The selection of a particular mortality table by a life insurance company depends upon its suitability for the group which is insured…”

[“This is Number 3 in a series of advertisements designed to give the public a clearer understanding of a how a life insurance company operates…”]

Curator’s Note: In 1959, Metropolitan Life published tables of the best weight for each height for longevity, based on the company’s extensive insurance data. Over the next several decades, the company’s updates became known as the “Metropolitan Tables.” No such tables about cigarette smoking have ever been published by the company. There can be little doubt that mortality tables for cigarette smoking and lung cancer were known to life insurance companies in the 1950s.

Educational pamphlets about cancer

CANCER (7 pages)

Educational pamphlet prepared in cooperation with the American Society for the Control of Cancer

by the Life Conservation Service of John Hancock Mutual Life Insurance Company

1928

“…The Prevention and Curability of Cancer

“CANCER is no respecter of persons. Both rich and poor have cancer. Healthfulness of environment plays no part. The best sanitation does not help. Nevertheless, some cancers may be prevented.

“Although little is known as to the cause of cancer, it is agreed that chronic irritation is partly responsible for the disease. But what is chronic irritation? This term has been defined as a form of irritation inside or outside the body which brings about a state of continual inflammation or soreness. The causes of continual irritation should be removed.

“While cancer may occur in any part of the body, either inside or outside, some places seem particularly favorable for its development. These are the digestive organs, the genital organs, the breast and the skin…”

A MESSAGE OF HOPE ABOUT CANCER (2 pages)

Educational pamphlet by the Metropolitan Life Insurance Company approved by the American Society of the Control of Cancer*

Circa 1930

“CANCER CAN BE CURED

“ACT NOW! A DAY’S DELAY MEANS VALUABLE TIME LOST

“CURE IS POSSIBLE IN THE EARLY STAGES”

[*The American Society for the Control of Cancer, founded in 1913 by 10 doctors and five other civic leaders in New York City, was renamed the American Cancer Society in 1945]

A Message of Hope ABOUT CANCER (4 pages)

Educational pamphlet by the Metropolitan Life Insurance Company

Circa 1940

“For further information about cancer, write to the American Society for the Control of Cancer, 350 Madison Avenue, New York, N.Y., or to the cancer committee or other group in your community affiliated with it.”

There Is Something YOU Can Do About Cancer (4 pages)

Educational pamphlet by the Metropolitan Life Insurance Company prepared with the cooperation of the American Cancer Society

1946

“…How a Cancer May Be Prevented

“It is not yet known why cancer cells may be produced on one person and not on another person. It is known, however, that certain factors influence the development of cancer. Cancer is essentially a disease of middle or old age, although it sometimes develops in children and young adults. As old age approaches, the body tissues begin to break down or wear out, so to speak. They cannot protect themselves so well as they could in youth. Hence they are in a favorable condition for the development of cancer. However, other factors are involved, including, in most cases, long continued irritations or repeated injury of the tissues. For example:

“Take a man whose tongue and inner cheek surfaces are continually being irritated by jagged teeth or by dental appliances that do not fit properly…

“Or a man whose digestive tract is continually being irritated by faulty eating habits…”

WHAT YOU SHOULD KNOW ABOUT CANCER (8 pages)

Educational booklet by Arthur King, Good Reading Rack Service, Inc., New York, NY, for Pacific Telephone Employees

1955

“…KINDS OF CANCER

“3. Lung Cancer. Although cancer of the lung was once rare, it is now the most common form among men. It has been claimed that such environmental factors as air pollution or heavy cigarette smoking may be responsible.

“Anyone with a persistent cough or pain or discomfort in the chest should be examined by a physician at once. Lung cancer may sometimes be detected by means of the chest X-ray. While still localized, lung cancer can usually be checked by surgery or radiation therapy.

“4.Cancer of the Mouth and Throat. Cancer of the mouth and throat is five times more frequent in men than in women. Since a doctor can detect it easily by an ordinary examination, it is again one of the earliest forms to cure.

“People whose lips are cracked and dried from overexposure to the sun seem more susceptible to lip cancer, as are people who smoke pips and cigars over a long period of time. Chronic sores or dry-feeling white patches in the mouth should be seen by a physician. Persistent hoarseness, difficulty in speaking, or trouble in swallowing are other danger signs. Watch out also for a lump or knot on one side of the neck.

“Surgery, X-rays, or radium are all used to teat this type of cancer…”

facts about cancer (4 pages)

Educational pamphlet by the Metropolitan Life Insurance Company

1961

“…Although there is still disagreement as to whether excessive cigarette smoking causes lung cancer, there is increasing statistical evidence that it is an important factor. Pollution of the air by caner-causing agents is also under investigation as a cause of lung cancer. The intensive research studies that are being conducted on causative factors in lung cancer should eventually provide the answers…”

Possibly the first public health message by the Metropolitan Life Insurance Company on smoking and lung cancer… in 1966

“You may wonder about smoking and whether it increases the danger of lung cancer, heart disease and other ailments. Excessive cigarette smoking is now widely believed to be an important health hazard. Studies are continuing to further clarify how cigarette smoking affects health. Recent research suggests that the age at which smoking is begun and the depth of inhalation are more important than the amount smoked. Authorities strongly advise teen-agers especially not to smoke cigarettes. Because heavy smoking has been shown to aggravate high blood pressure and hardening of the arteries and chronic lung disorders of all kinds, persons with heart and lung disease are often advised to cut down on their smoking or to stop altogether…”

— From “YOUR GUIDE TO GOOD HEALTH,” Metropolitan Life Insurance Company, 36 pages,

1966**

The evolution of medical underwriting in life insurance

Excerpt of an article by Naheed Kheraj

In The Proceedings of the 16th Annual History of Medicine Days, March 30th and 31st, 2007 Health Sciences Centre, Calgary, Alberta, Canada

http://hdl.handle.net/1880/47540

“The concept of insurance as a way of spreading the risk of financial loss over many individuals has existed for thousands of years. Historians believe that insurance first developed in Babylonia around 3000 BCE. Merchants and traders who transported goods by ship used to pool their money to protect against losses of cargo to thieves and pirates…

“The earliest forms of life insurance originated in ancient Greece and Rome around the 4th century BCE. Citizens formed benevolent societies where members paid dues that went towards paying for the burial expenses of members who died…

Modern insurance, or what is thought of today in terms of written contracts with insurance companies, is a…phenomenon of the last 400 years. Over this period of time, insurance became more formalized, and branched out into many different areas of coverage. The first known life insurance policy was written in London in the late 1500s. Fire insurance became more common, especially after the Great Fire of London in 1666…

“Inherent in the concept of insurance is the idea of homogeneous populations. That is, the level of risk that each individual brings to the pool should be roughly commensurate with the average risk of the pool. This introduces the ideas of underwriting and risk classification… There are two main reasons why it is desirable to have homogeneous populations. The first is simply a matter of fairness, that everybody in the pool sharing in the risk should have a similar level of risk as everyone else. For example, it wouldn’t really be fair to have a 20 year-old female paying the same premium as a 60 year-old male for the same amount of life insurance. Second, having similar risks grouped together also reduces the statistical variability of losses and thereby lowers the overall level of risk within the pool.

“Prior to the 1940s, insurers only had one risk class, differentiated by age. In the 1940s, life insurers began introducing sex-distinct risk classes, recognizing the mortality differences between males and females. This doubled the number of risk classes from 1 to 2 (male and female). A graph of mortality rates (qx) by age (x) would show a roughly exponential curve with very low rates at younger ages and a steeply increasing curve at older ages. Males generally have higher mortality rates than females at almost every age. In the 1970s, life insurers further divided the sex-distinct risk classes into smoker-distinct classes, recognizing the accumulated evidence which showed that smokers experienced higher mortality rates than non-smokers. This change again doubled the number of risk classes from 2 to 4 (male non-smoker, male smoker, female non-smoker, and female smoker). This was a more equitable risk classification method, because the non-smokers were no longer subsidizing the smokers who had worse mortality. During the 1980s, competition among life insurers intensified…

“As a consequence, during the 1990s, some life insurers began designing more innovative products by further stratifying their risk classes. They split their standard non-smoker class into a preferred non-smoker class and a residual non-smoker class. Using various underwriting criteria, such as blood pressure and cholesterol, the insurance companies selected out the ‘healthier’ non-smokers, and gave them a preferred rate because they were likely to have lower mortality…”

Early publications on smoking, cancer, and longevity

MEDICAL EXAMINATION FOR LIFE INSURANCE (92 pages)

By Thomas D. Lister

Published by Edward Arnold and Co., London

1921

(Provided by Nathan Schachtman, JD, New York City, May 2024)

“Smoking to excess is like drinking to excess, a relative term, but with tobacco there is probably a larger margin between excess and moderation than there is for alcohol. Whereas for alcohol a daily two ounces may be considered to be the physiological limit, yet it is by no means unusual to find smokers who average an ounce of tobacco a day without apparent detriment to their heart or blood pressure. With cigar smokers there may be any number from one to ten or more, and with cigarette smokers up thirty or forty in the day.

“A doubt as to excess in the use of tobacco will arise when the proposer has an irregular, unequal, or intermittent pulse, or his blood pressure is raised. Some offices desire an answer to the question as to what amount of tobacco is consumed in the week, but to the author’s knowledge they are satisfied with an answer that varies between three or four cigarettes a week and 150 in the week provided that there are no symptoms of tobacco poisoning. Should there be an intermittent or irregular pulse in a case where a large amount of tobacco is consumed, it is best to retest the proposer early in the day after asking him to abstain for a day or two. A past history of tobacco poisoning, including even amblyopia, if the habit has not recurred and the proposer is well, entails neither an extra premium nor delay in acceptance in comparatively young proposers. In proposers approaching middle life and later, tobacco poisoning involves risks of high blood- pressure ensuing.”

“TOBACCO SMOKING AND LONGEVITY” (2 pages)

Special article by Raymond Pearl

School of Hygiene and Public Health, Johns Hopkins University

SCIENCE

Volume 87, No. 2253, March 4, 1938

“The figures presented here deal only with white males, and concern only the usage of tobacco by smoking. The material falls into three categories, as follows: non-users of tobacco, of whom there were 2,094; moderate smokers, of whom there were 2,814; and heavy smokers, of whom there were 1,905. In other words, the results presented here are based upon the observation of 6,813 men in total. These men were an unselected lot except as to their tobacco habits. That is to say, they were taken at random, and then all sorted into categories relative to tobacco usage.

“…However envisaged, the net conclusion is clear. In this sizable material the smoking of tobacco was statistically associated with the impairment of life duration, and the amount or degree of this impairment increased as the habitual amount of smoking increased…”

From the German medical journal Zeitschrift für Krebsforschung, Berlin 30: 317-448 (Dec. 16) 1929, as reported in the Journal of the American Medical Association, March 29, 1930

“Tobacco and Tobacco Smoke as a Factor in Etiology of Cancer. — Lickint reviews the experimental and clinical work that has been done on this problem. As yet only atypical epithelial proliferations (not true cancer) have been produced in animals by means of tobacco tar. The author calls attention to the fact that of the 4,059 cases of cancer of the bronchi and the lungs reported in the literature, 3,370 were in men and only 689 in women (a ratio of 5 : 1), and also to the increasing frequency of cancer of these organs. He believes that this is to be explained in part by the great increase in cigaret smoking, with its attendant inhalation. Not only smokers but nonsmokers are exposed to this danger in smoke filled rooms. Because of the finer state of division of the particles in tobacco smoke, they have a much greater penetrating power than have particles of dust. In the case of tobacco smoke the maximum amount of irritation is produced because, in addition to the mechanical irritation (particles of carbon), there is also a chemical (tarlike combustion products) and a thermal (current of heated air) irritation. Other investigators who believe that tobacco smoke, particularly cigaret smoke, is partly responsible for the increased incidence of cancer of the bronchi and the lungs are Perret, Joannovic, Kanngiesser, Berblinger, Fahr, Hochstetter, Ferenczy and Matolcsy and Schonherr. Because of the long time that nicotine and other products of the burning of tobacco remain in the liver and urinary bladder, the author believes that primary cancer of these organs also is sometimes caused by tobacco. The article is followed by a bibliography containing 167 references.”

“TOBACCO SMOKING AND LONGEVITY” (2 pages)

Article by Edwin B. Wilson

Office of Naval Research, Boston

Proceedings of the NATIONAL ACADEMY OF SCIENCES

Volume 52, Number 2, August 15, 1964

“Pearl did not state his definition of heavy smokers, nor specify what they smoked; this makes detailed comparison with recent studies impossible. The striking thing about his figures is the high mortality ratios at ages 30-45 and the consequent great shortening of life expectancy. Are such high ratios for the youngere smokers real or only statistical artifacts? There is not way to give a definitive answer to this question because different authors with different populations and with different methods fail to put their data in sufficiently comparable form so that the proper comparisons can be made. This is too bad, for if the data were in comparable form and the high mortality ratios turned out to be real, a careful study of the young deaths, even though relatively few, might be more illuminating than the study of the run-of-the-mill cases in the age range of maximum incidence and relatively low mortality rates…”

Advertisements on preventing or reducing the risk for numerous diseases

“The Toll of Water”

Advertisement by the Metropolitan Life Insurance Company

The National Geographic Magazine

Circa 1925

“During the months of July, August and September, deaths from accidents lead all other causes – except heart disease and tuberculosis – among the 22,000,000 policyholders in the Metropolitan Life Insurance Company. Deaths from drowning are at their height during the months.

“In July 1924 the number of deaths among Metropolitan policyholders from drowning was about twice as many as from typhoid fever and diphtheria together. [More than 6000 perished last year in the United States from drowning accidents.]

“It is the duty of parents to have their children instructed in swimming and the art of resuscitation, so that the danger of drowning attending summer vacations may be minimized…”

“A Family Problem”

Advertisement by the Metropolitan Life Insurance Company

Collier’s, The National Weekly

July 31, 1926

“The Metropolitan Life Insurance Company recognizes the importance of protecting the feet as a means of safeguarding health. It has just published a booklet, ‘Foot Health’ which contains a great deal of valuable information.

“This booklet tells about the various kinds of foot troubles-and what causes them. It explains how to avoid the suffering and dangers attendant upon foot ailments. It shows how incorrect shoes and wrong methods of walking and standing cause foot distress and often contribute to bodily ills and mental depressions.

“It will be a pleasure to us to send this booklet to anyone needing help. Just ask for ‘Foot Health’ and it will be mailed free of charge.

HALEY FISKE, President”

“Try This At Home”

Advertisement by the Metropolitan Life Insurance Company

The American Magazine

September 1927

“Progressive Boards of Education, all over the country, recognize that pupils must sit properly during study hours. Curvature of the spine is sometimes caused by desks and chairs which do not permit the child to sit straight. Posture is taught in the daily calisthenics classes. Fatigue and malnutrition are guarded against, as frequent causes of bad posture.

“Magazines and newspapers, more and more, are urging their readers to learn not only the advantages of correct posture, but also the dangers that attend bad posture.

“In the Home Office of the Metropolitan Life Insurance Company striking physical improvement among our employees has been brought about by our Director of Posture. Bent bodies have been straightened. Headaches and other ailments of obscure origin have been made to disappear. Low spirits have been raised. Learning how to stand and sit correctly has added to health and happiness.

“A valuable booklet on the subject of posture has been prepared and one copy will be mailed free to each person requesting it. Send for ‘The Importance of Posture’.

HALEY FISKE, President.”

“Speak Up!”

Advertisement by the Metropolitan Life Insurance Company

The American Magazine

November 1928

“…Your government will be as sound and wise as you and other Americans make it. You have great responsibility and great power. It is your duty to exercise that power. And the way to exercise it is through your vote. Do not neglect it.

“By failing to vote, you offer encouragement to the political plunderer and other unscrupulous persons who are eager to profit by the opportunity you give them. Only by voting can the majority of Americans holding like opinion dictate their wishes and save themselves from the danger of being governed by a minority holding opposite opinions.

“Your next President will not be a despot or a dictator. He will not make or unmake laws, but he has great power and influence and will go into office bound to use them to bring about the kind of government by those who elected him…

“Be a good citizen. Go to the polls on November 6th and vote.”

“The ‘Teen Age'”

Advertisement by the Metropolitan Life Insurance Company, illustration by James Montgomery Flagg

The Saturday Evening Post

March 28, 1931

“Look at that fine boy of yours, brought safely through childhood ailments. Now, as he enters his “teens”, while he is still growing, he must build his health to guard against tuberculosis — a mortal enemy of those in run-down condition.

“Adolescence is a critical age in physical development. It is a period of special strain — when growth and change are rapid — and when health and strength must be kept at the highest possible point.

“Your boy may be tempted to over-tax his strength and undermine his vitality by striving to compete with older and stronger boys. Or your daughter may risk her health by too much social activity added to her school work, or by dieting in an effort to keep slender in emulation of some screen celebrity. Low vitality and under-nourishment make

boys and girls especially susceptible to tuberculosis…

“Perhaps during no age in life are annual physical check-ups more important and valuable than during adolescence…”

“The Heart Disease Paradox…

In this country more cases of heart disease are being prevented each year – yewt more deaths are charged to the heart than ever before.”

Advertisement by the Metropolitan Life Insurance Company

The American Magazine

September 1934

“…Better protection of children against diseases which are often followed by heart trouble means that fewer young hearts are being exposed to injury…Better control of venereal and other diseases that damage hearts has been another important factor in reducing the deathrate from heart disease at all ages up to 45 years.

“You can help to prevent heart disease in your home by having your children immunized against diphtheria and by protecting them, so far as possible, against other heart damaging diseases, such as sore throats, repeated colds, acute rheumatic fever, scarlet fever, measles and typhoid fever…

“More than half the readers of this page, who are about 35 years old, will pass the age of 70; and one out of five will outlive fourscore years. Many a man is adding years to his life and is enjoying what is literally a new lease on life by taking care of his heart and by making intelligent change in his living habits.”

“Make Playtime a SAFE TIME

SUPPORT YOUR LOCAL SAFETY MOVEMENT“

Advertisement by the Metropolitan Life Insurance Company

TIME Magazine

October 11, 1937

“UNCLE RED’s A. B. C. Club started in Providence, R.I., during 1926. Today it has more than 75,000 members, between the ages of five and fifteen, and each one has pledged himself to ‘Always Be Careful!’

“‘The club has been a great factor in the reduction of child accidents and fatalities,” states the Mayor of Providence. This city has won the National Traffic Safety Contest for cities of its size three times in succession.

“Sponsored by the local automobile organization, the A. B. C. Club holds regular weekly meetings over the air. Actual accidents are discussed, ways of avoiding their repetition are pointed out and seasonable advice is given to thousands of youthful listeners-in. The club is an example of how a local organization can help make streets and highways safer through continuous and well-directed efforts.

“The reduction of accidents commands the active cooperation of everyone — young and old…”

“The Next Great Plague to Go”

Advertisement by the Metropolitan Life Insurance Company

The Saturday Evening Post

January 29, 1938

“TODAY syphilis is causing more misery of mind and body than any other preventable disease. Five hundred thousand new cases are reported under treatment by physicians each year. Hundreds of thousands of other cases never receive proper medical care…

“Most new cases can be cured – completely cured – provided correct treatments started immediately. Why then does syphilis wreck so many lives? On big reason is that in its early stages the disease creates little personal discomfort. In addition, charlatans and quacks often can deceive syphilitic patients. Early symptoms – usually a sore, a rash or a persistent feeling of not being well – disappear no matter how unscientific or inadequate the treatment…

“The American Social Hygiene Association, through its National Anti-Syphilis Committee of over 200 prominent people, is sponsoring the second National Social Hygiene Day, February 2nd, 1938. On this fay, citizen groups and physicians all over the country will meet with officials to plan the next steps to take in stamping out syphilis…”

“Lengthening His Waistline …Shortening His Life-Line”

Advertisement by the Metropolitan Life Insurance Company

Collier’s Magazine

February 19, 1949

“Like one out of every four people in our country today, this man weighs more than he should…

“Statistics show that if weight is more than 10 percent above normal, life expectancy is usually reduced about 20 percent…It has been estimated that 10 pounds of extra fat require the development of half a mile of blood vessels. To maintain this excess body tissue, the heart has to work harder. Fortunately, with good medical care, overweight can usually be corrected.”

“The Doctor looks at Diabetes”

Advertisement by the Metropolitan Life Insurance Company

TIME Magazine

October 15, 1951

“It is estimated that there are one million people in our country who have diabetes…

“Their chances of living happy, useful lives are better today than ever before. In fact, life expectancy for the average diabetic is now double what it was before the discovery of insulin…

“Doctors say, however, that successful control of diabetes more than ever depends largely upon the diabetic himself, who must understand his disease in order to learn to live with it. Above all, he must cooperate closely and faithfully with his physician in keeping insulin, diet, and exercise in correct balance…”

“How well do you know

YOUR HEART?”

Advertisement by the Metropolitan Life Insurance Company

Newsweek

February 4, 1957

Curator’s note: The following quote from 1954 is possibly the first mention by the Metropolitan Life Insurance Company of a relationship between cigarette smoking and heart disease.

“If your doctor finds that you have any form of heart trouble, he will tell you so. Sometimes when people are told that they have heart trouble, they begin to blame themselves. They think if only they had not exercised so much, or smoked so much. They are wrong in feeling this way, for doctors today believe that although such overindulgences are harmful after the heart is diseased, they rarely bring on injury to the heart…”

“If you’re a confirmed smoker, you perhaps feel that smoking relaxes you. However, it seems to have the opposite effect on your blood vessels. Recent experiments have shown that when you smoke, your arterioles almost immediately tighten or constrict, and your blood pressure goes up. So of course if you have high blood pressure or hardening of the arteries, it’s probably advisable for you not to smoke or to limit your smoking. Your doctor will advise you about this.”

— From “YOUR HEART,” Metropolitan Life Insurance Company (“prepared with the cooperation and advice of the American Heart Association”), 20 pages, 1954

Depictions of the lit cigarette in fire insurance advertisements

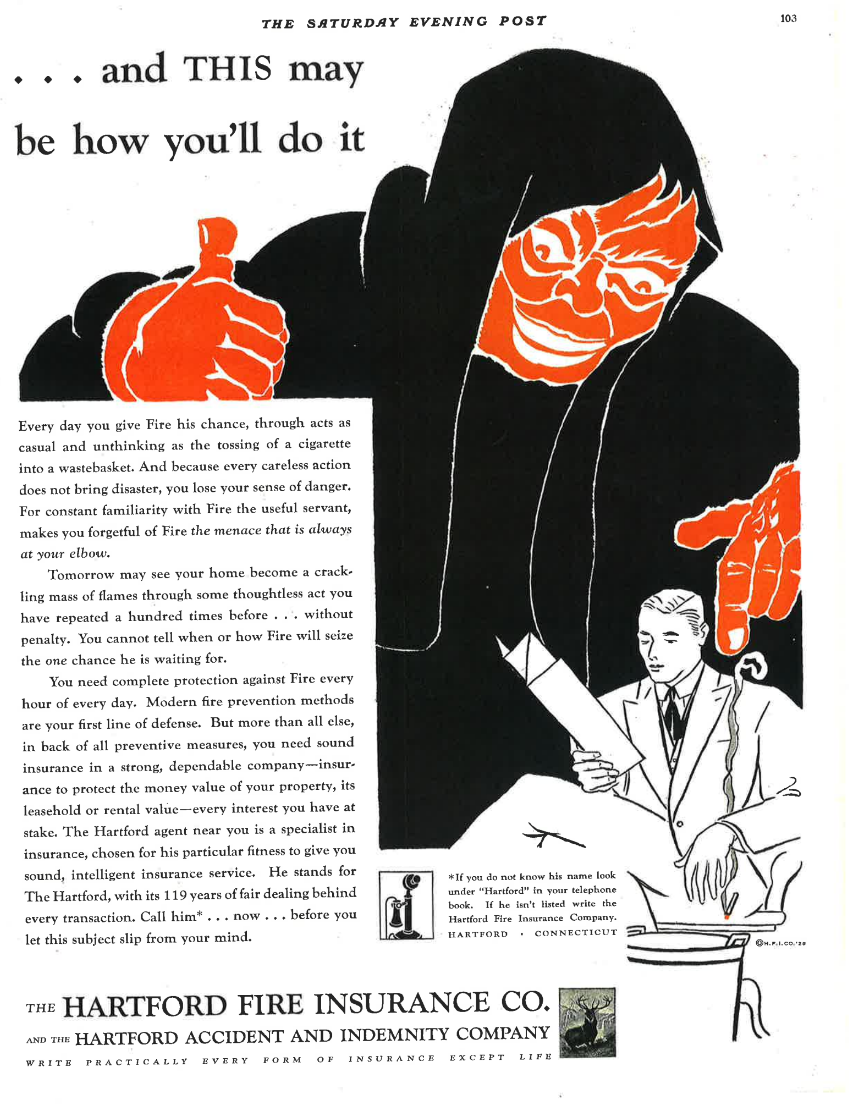

“Going up in smoke!”

Advertisement by Insurance Company of North America

The Saturday Evening Post

April 25, 1927

“This is no case against tobacco, skillfully prepared for the pleasure and satisfaction of mankind. Only the smoker is to blame when destruction follows hard upon enjoyment of a ‘smoke’.”

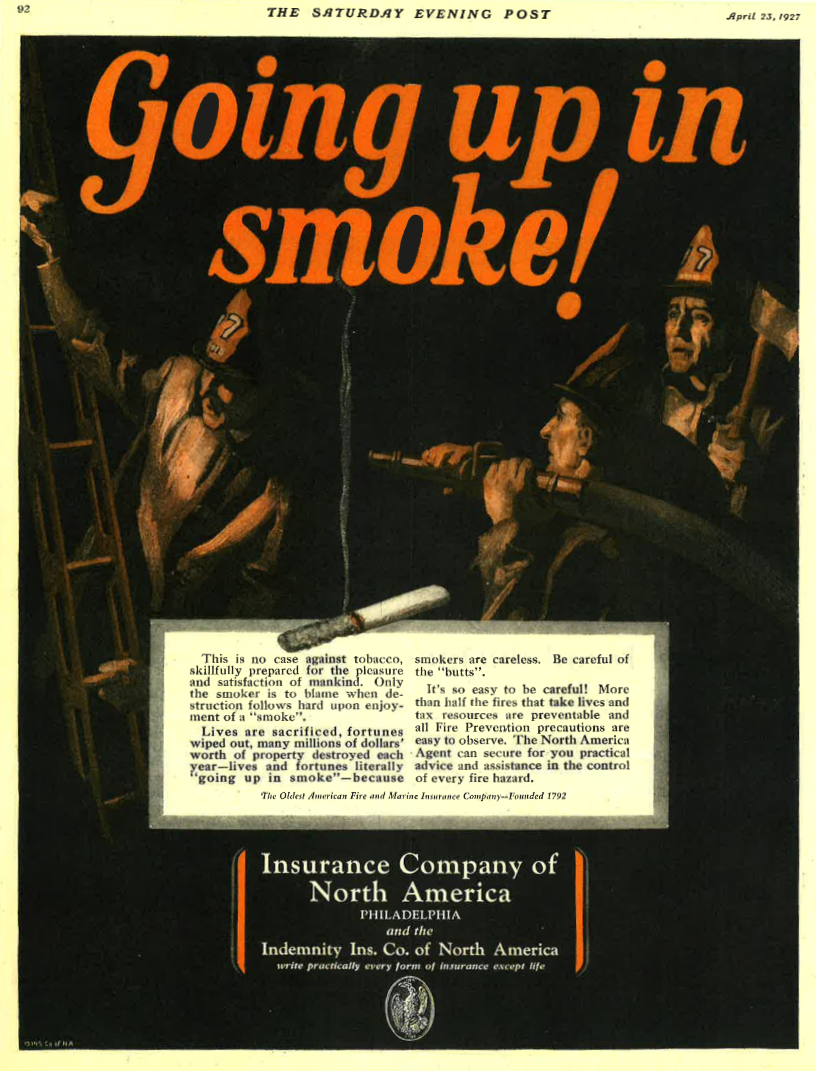

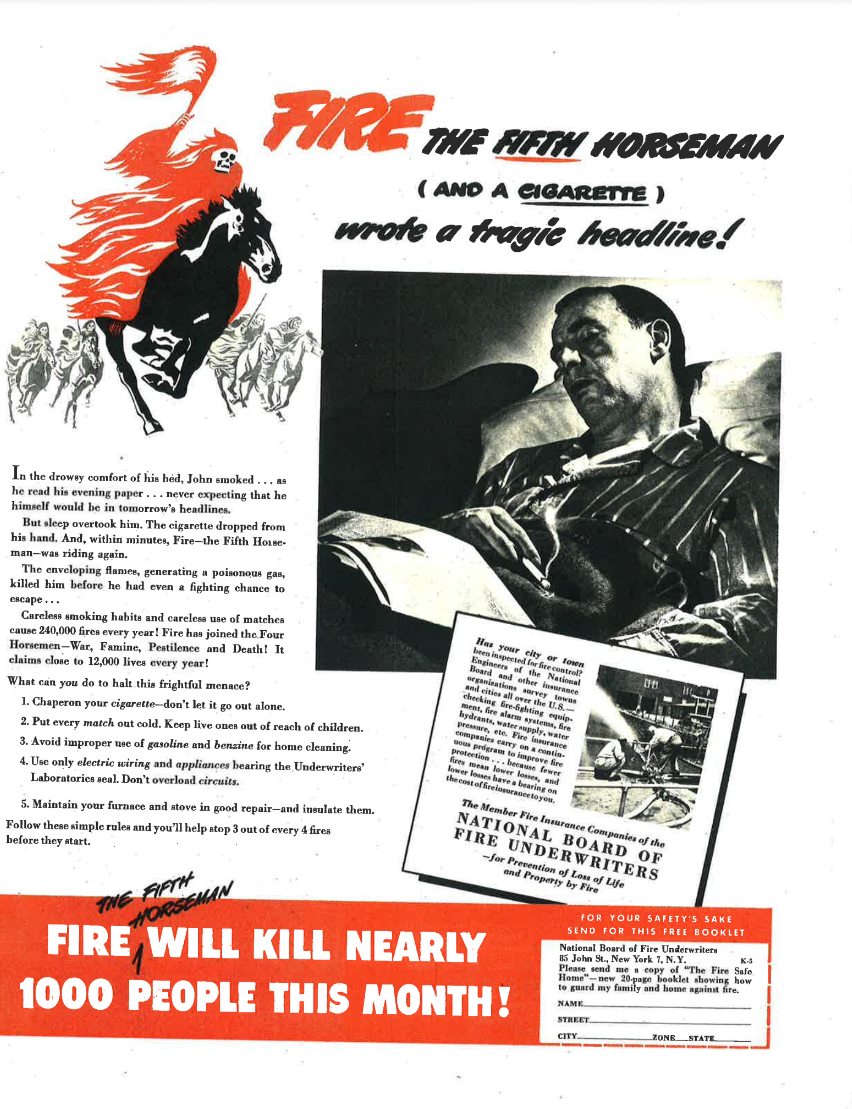

“FIRE THE FIFTH HORSEMAN

(AND A CIGARETTE)

wrote a tragic headline!”

Advertisement by National Board of Fire Underwriters

LIFE Magazine

1948

“In the drowsy comfort of his bed, John smoked … as he read his evening paper … never expecting that he himself would be in tomorrow’s headlines.

“But sleep overtook him. The cigarette dropped from his hand. And, within, minutes, Fire – the Fifth Horseman – was riding again.”

“Insure Your Dwelling and Household Goods”

Promotional bookmark by the Federal Mutual Fire Insurance Company

Circa 1940

“When e’er you smoke,

your first concern —

An ash-tray near

that cannot burn.

Then firm resolve

that you will not

Risk fire in

any other spot.

That if you hear

the sandman’s rap,

You’ll quench all fire

before you nap.”

–“Lady Nicotine’s Advice to Devotees”

“’CAN I BLOW IT OUT, DAD?’”

Advertisement by the Hardware Mutual Casualty Company/Hardware Dealers Mutual Fire Insurance Company

TIME Magazine

October 9, 1950

“‘All right, Jimmy. But remember, it’s a lot easier to blow out a little match than it is for the Fire Department to put out a big fire that a match can start. That’s why children should never play with matches!’

“During Fire Prevention Week, October 8th to 14th, cooperate earnestly with your Fire Department by eliminating the causes of fires. And observe the fire prevention rues all year ‘round, too. You’ll be helping them all in their untiring efforts to save lives and preserve property.

“Keep matches out of reach of children…”

“Good..

They’ve got to be good!

No false alarm about Chesterfields…

AT THE TAP OF THE GONG 516,363 FIREMEN [IN THE U.S.A.] spring to action, ready for anything!

‘Go – we’ve got to go.’ Off at a moment’s notice. Off to nobody knows what dangers. Good – we’ll say they’re good. Hats off to these fearless men!”

Newspaper advertisement by the Liggett and Myers Tobacco Company

1931

Curator’s note: Smoking-caused fires account for 2 percent of the 7600 residential building fires in the US, but they are a leading cause of deaths in home fires, accounting for 14 percent of such deaths. (Source: Smoking-Related Fires in Residential Buildings. US Fire Administration, 2012)

Health insurance promotional items

Four promotional matchbooks by Blue Cross Blue Shield hospital, medical and surgical care insurance (“Your Voluntary Non-Profit Health Service Plans” “Partners in Health” “WORRY-FREE RECOVERY” “The plans that CARE for you”) –Albany, New York; Richmond, Virginia; Sioux City, Iowa; Milwaukee, Wisconsin.

Circa 1940s, 1950s

Promotional matchbook by the Metropolitan Life Insurance Company (“ASK ABOUT THE METROPOLITAN FAMILY PROTECTION PLAN”)

Circa 1930

Philip Morris employee life insurance benefit

“A PLAN FOR LIFE INSURANCE”

Section from Philip Morris Inc. employee benefits booklet, “THE HOUSE THAT YOU BUILT”

1953

“At my death, I know the family will receive some ready cash from the PHILIP MORRIS Life Insurance Plan.

“I don’t have to worry about the premiums because my company pays these.

“If I hold a regular, full-time job with PHILIP MORRIS, I will get free life insurance immediately after I have been with the Company 3 months…”

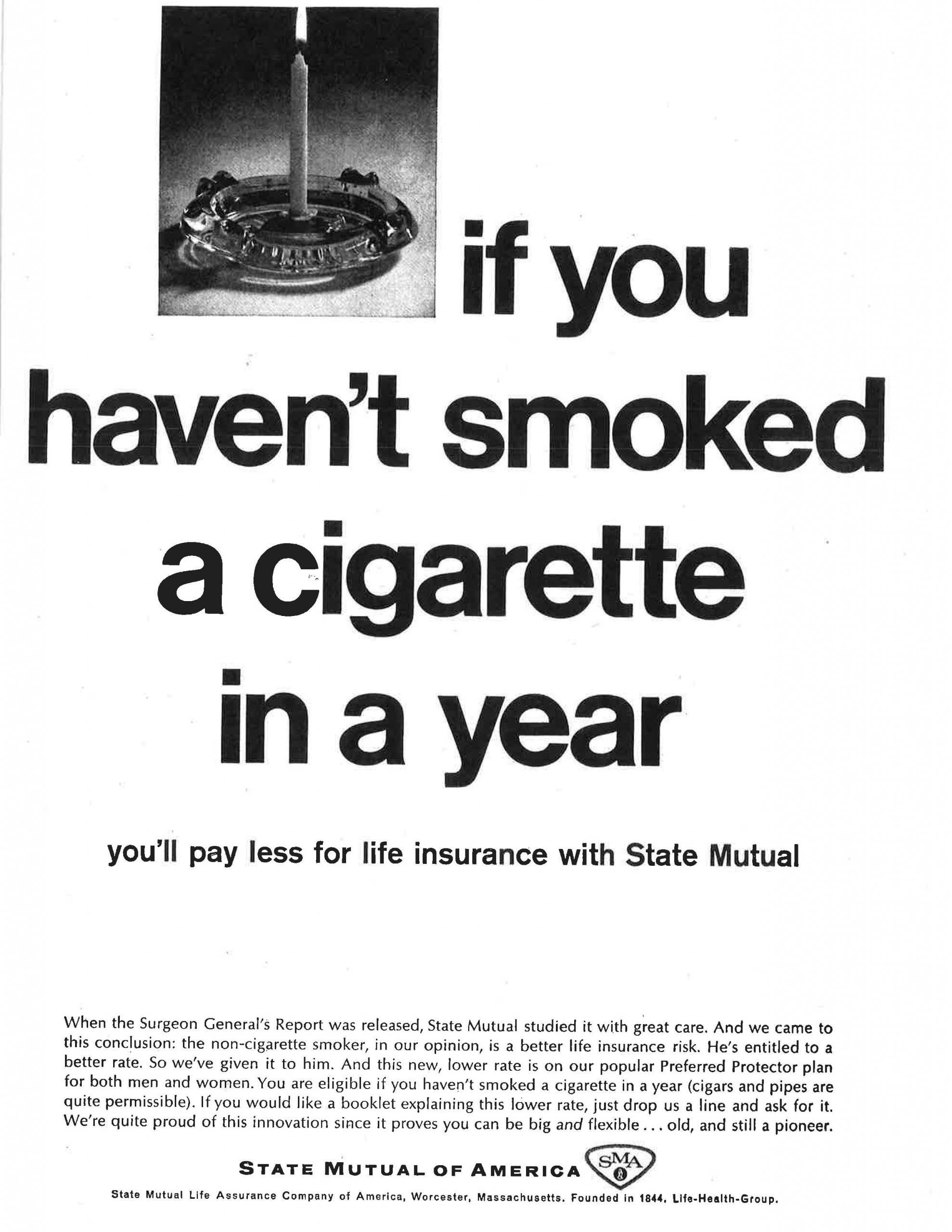

The first national advertisements by a life insurance company for a non-smoker’s discount

“Gentlemen:

I understand you offer a lower rate on new life insurance to people who haven’t had a cigarette in at least a year … or ever. Not because you’re crusaders, but simply because you feel non-smokers make better life insurance risks. Please send me a free folder explaining your low-cost non-smokers plan.”

Advertisement by State Mutual of America

U.S. News & World Report

February 27, 1967

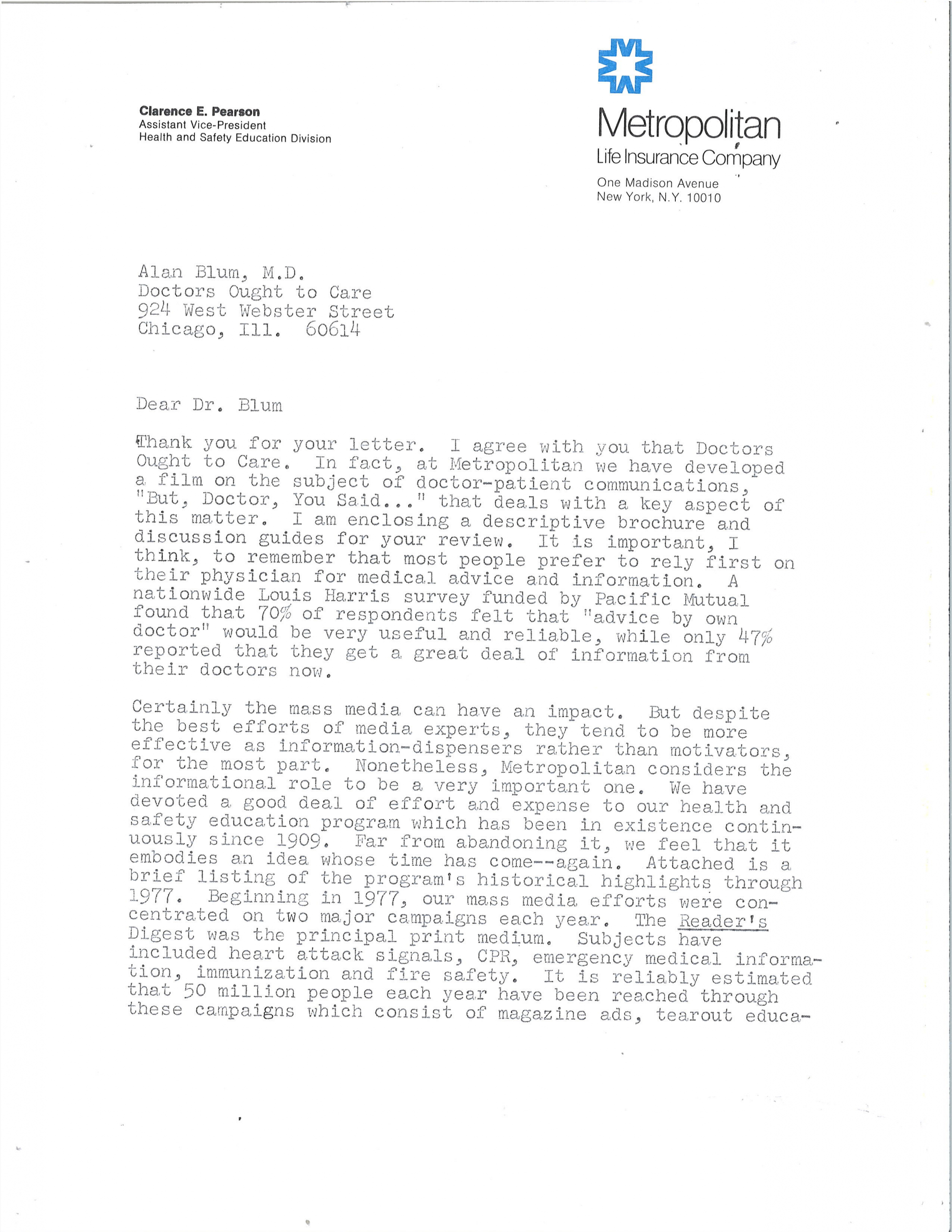

“An insurance company perspective on smoking” (4 pages)

Article by Michael J. Cowell, vice president and actuary.

State Mutual Life Assurance Company of America

New York State Journal of Medicine

Volume 85, pages 307-309, July 1985

“…State Mutual based its action on the belief that persons who choose not to smoke should not be made to to subsidize insurance costs resulting from cigarette smokers’ extra death claims. As a mutual company owned by policy-holders, it had a tradition stretching back to the early 19th century of providing life insurance at cost.

“State Mutual did not take this action out of a belief that smoking was immoral. Rather, the statistical evidence of much higher death rates among persons who smoke was so overwhelming that the company could no longer ignore it in pricing insurance…

“In hindsight this move may not seem that bold. However, viewed in light of smoking habits in 1963, just before the Surgeon General’s first report was published, it was a radical step… As recently as the year prior, the Society of Actuaries had sponsored a panel discussion on using smoking as a risk factor, the general consensus being that this was totally impracticable in underwriting life insurance…”

Early news reports about life insurance companies that offered a non-smoker’s discount

“Strange if True…”

Article in TOBACCO, The International Weekly [tobacco industry trade journal]

April 6, 1962

“Reports are persistent — but unsubstantiated — that the Metropolitan Life Insurance Company is readying a blast against tobacco use and is preparing to offer reduced premiums to non-smokers.

“The insurance firm, as group life insuror for employees of the American Tobacco Company, furnished the independent death reports utilized by the cigarette company in its recent study showing a lower mortality rate among ‘American’ employees who smoke more than the general populace.”

“Insurance Co. Gives Break to Non-Smokers”

Article in TOBACCO

December 7, 1962

“BEVERLY HILLS, CALIF. — Executive Life Insurance Company is offering non-smokers a discount on their life insurance premiums in the belief that such persons have a higher life expectancy than habitual smokers, the company announced here Monday.

“The company said this is the first recognition given in life insurance rates to findings of adverse health effects of tobacco use.

“The new five per cent discount on premiums is applicable to full life and four-year renewable term policies and is available to nonsmokers at least 30 years old who must sing a statement that they never have smoked.”

“Insurance Firms Join Anti-Smoking Campaigns”

Article in TOBACCO

October 1, 1965

“JOHANNESBURG, So. AFRICA — Schools in South Africa are not the only institutions to have started anti-smoking campaigns as the latest drive has been launched by life insurance companies.

“Two firms are refusing to issue policies for smokers or are loading premiums for smoking policy holders, according to a Johannesburg insurance broker.

“The broker said: ‘It will not be long before most big life companies will act against smokers.

“‘This is because the medical profession in South Africa, like doctors elsewhere, accepts more and more that there is a link between smoking, lung cancer and other diseases.’

“According to the broker some clients are being turned down by companies because they smoke. The companies say they are ‘not interested’ in accepting smokers even with loaded premiums.”

“Another thorn…”

TRADE WINDS column news item by Lou Schneider

TOBACCO

October 6, 1967

“As if the tobacco companies didn’t have enough anti-smoking trouble from political and medical groups, the life insurance companies are a new thorn. Several life insurance companies are now offering reduced rates to non-smokers who may be able to save as much as six per cent of their premiums by abstaining. Coupled with the spiraling taxes on cigarettes, the insurance people might do something the health scare couldn’t.”

“DISCOUNT INSURANCE RATES FOR NON-SMOKERS” (2 pages)

RADIO TV REPORTS, INC. transcript of “Stories Behind the News”

WRC Radio

Washington, DC

October 24, 1963

(Document from the files of HILL AND KNOWLTON, INC., public relations firm for tobacco companies, found in search of tobacco industry documents of the University of California at San Francisco [TITX 0037877 and TITX 0037878])

“Surveys linking cancer with cigarette smoking have failed to stem the habit with thousands of people. They continue puffing away, at times thinking of the possible health hazard, and occasionally perhaps reflecting on the economy of a budget without the usual carton of cigarettes every week. Whether it is the health hazard or the economy that forces one to quit smoking cannot be measured exactly, presumably a combination of both. But the economy is playing an important part – more so nowadays than in the past.

“And one area of saving money for a non-smoker is in insurance. Premiums can be bought at a discount…

“Some small insurance companies began offering non-smokers better rates on their policies about two years ago. Now the offer seems to be catching on. Life insurance companies traditionally charge higher rates for some people – health risks, heavy drinkers or workers in dangerous jobs. But non-smoker insurance means a reward in terms of lower rates. Some policies offer a 15 per cent discount. Others pay added death benefits and special dividends…”

“Risk Firm Offers to Non-Smokers Policies with Bonus Death Benefits”

Article by Lester Buck

Wichita Eagle and Beacon

August 11, 1963

(Document found in search of tobacco industry documents of the University of California at San Francisco TITX 0037884)

“Kansas — and Wichita in particular — will be used as a testing ground for sales techniques designed to reach the one in five citizens who qualify for these special policies…

“The policies will be offered by Great American Reserve Insurance Co. of Dallas, Texas.

“’Wichita and Kansas in general represents a good cross-section of America for sales research,’ Travis T. Wallace, Great American Reserve board chairman, told The Eagle and Beacon.

“Perhaps Wallace’s interest in non-smokers is heightened by the fact he is also chairman of the executive committee of the American Cancer Society.

“Wallace said his company would guarantee to pay the beneficiaries of insured non-smokers 20 per cent extra if death occurs within five years after the policy is written. For instance, a $10,000 policy purchased at the regular rate would be worth $12,000. After the first five years, Wallace said, the bonus payment above face value of the non-smoker policies will be determined by actual mortality rates. Wallace said one set of statistics on which his company based Its non-smoker policy plan shows the. projected death before-65 rate of 100 men now age 35. ‘We believe,’ Wallace said, ‘that among non-smokers, 23 of that 100 will die before age 65. Of cigar and pipe smokers, 25 will die before 65; of men smoking less than 10 cigarettes a day, 27 will die before 65; of those smoking up to a pack a day, 34 will not live to 65, and of those smoking two packs a day or more, 41 will die before 65.’

“Wallace said statistics show smokers who quit move into a lower mortality rate, but never back to the original non-smoker level. Hence, the company will not accept ex-smokers…

“Women are not included in the offer, Wallace said, ‘because the average woman started smoking at a later date, smokes less and inhales less.’

“Previously, only two small insurance firms, Executive Life Insurance Co. of Beverly Hills, Calif., and Fortune National Life Insurance Co. of Madison, Wis., have offered lower rates to non-smokers, a Wall Street Journal report showed…”

Letter from Edward H. DeHart to Dr. Frank J. Walsh, Executive Vice President, The Tobacco Institute, Inc.

August 30, 1963

(Found in search of the University of California at San Francisco tobacco industry documents website [TITX 0037879 and TITX 0037880])

“To the best of our knowledge only three American insurance companies, all small, offer special benefits to non-smokers. They are:

- Great American Reserve Insurance Company, Dallas, offers non-smoking policy holders the option of electing to receive an additional amount of paid-up term insurance. The plan is experimental and localized in Kansas.

- Fortune National Life, Madison, Wis., offers a special form of endowment insurance with lower premiums for non-smokers. The annual premium at age 25 is lowered from $12.95 to $11.01; at age 45, from $27.27 to $24.58. To qualify, applicants must not have smoked for the preceding 24 months and must pledge not to smoke in the future.

- Executive Life Insurance Company, Beverly Hills, Calif., offers lower rates to non-smokers, but we do not have specific details.

“A London firm of insurance brokers in 1958 offered non-smokers a five percent reduction of auto insurance premiums and a reduction of 10 pounds on personal accident and sickness policy premiums. The plan was unsuccessful and was discontinued in 1960…”

“Back on the Job —

Ken Stockman, Iron Worker,

Survived His Heart Attack”

Advertisement by the Heart Fund (forerunner of the American Heart Association)

Newsweek

March 2, 1964

(Public service advertisement, space donated by the publisher)

“Most heart attack victims now survive first attacks. And three out of four who do, go back to their jobs — some even to rugged jobs.

“Heart Fund dollars invested in research helped make this progress possible through advances in diagnosis, treatment and rehabilitation.

“But heart attack still kills 500,000 in the U.S. annually. Fight this Number 1 killer with the best weapon you have — a generous gift to your Heart Fund volunteer.

“More will LIVE the more you GIVE

HEART FUND”

“Don’t blindfold him!”

Advertisement by the American Cancer Society

Newsweek

October 14, 1963

“THE AWESOME-looking instrument in the picture above is an electron microscope. Through it, a cancer researcher can observe the detail of a cancer cell-magnified 100,000 times.

“The microscope costs $35,000 and was paid for by American Cancer Society funds – which support 1300 scientists, all working to find the cause of cancer, and its prevention.

“Don’t blindfold cancer research. Give to it. Send your contribution to CANCER, c/o your local post office.”

Curator’s note: The three major national non-government health organizations that self-identify as leaders of the effort to reduce smoking in the U.S. are the American Cancer Society (ACS), the American Heart Association (AHS), and the American Lung Association (ALA). Although the ACS (founded in 1913 as the American Society for the Control of Cancer and given its present name in 1945) helped fund the pioneering epidemiological studies on cigarette smoking and lung cancer by E. Cuyler Hammond, PhD and Daniel Horn, PhD in the 1950s and (along with the AHS, the American Public Health Association, and the National Tuberculosis Association) in 1961 urged President John F. Kennedy to form a national commission on smoking, the ACS did not launch a significant national campaign to reduce smoking until 1977 with its one-day-a-year Great American Smokeout. The ACS’s antismoking efforts in the 1960s consisted largely of posters, pamphlets, and public service advertisements in magazines on TV and radio (ie, in unsold advertising slots donated by publishers and broadcasters). More commonly, ACS ads sought donations for cancer research.

Founded in 1915 as the Association for the Prevention and Relief of Heart Disease and renamed the American Heart Association in 1924, the AHA was not involved in combating tobacco use until 1961. Its efforts before then were largely devoted to raising funds for research on heart disease through its Heart Fund.

The American Lung Association, founded in 1904 as the National Association for the Study and Prevention of Tuberculosis and renamed the National Tuberculosis Association in 1918, acquired its present name in 1973 to “better reflect efforts to fight a variety of threats to lung health,” according to its website. A typical public service advertisement for the organization in the 1960s was “FIGHT TUBERCULOSIS, EMPHYSEMA, AIR POLLUTION. Use Christmas Seals [a fund-raising effort using stamps on letters and packages to call attention to lung diseases]” (example from TRUE. The Man’s Magazine, January 1968). The ALA’s first nationwide smoking cessation program, “Freedom from Smoking,” was launched in 1982.

“Psychic Defenses Against High Fear Appeals: A Key Marketing Variable” (7 pages)

Article by John R. Stuteville, PhD

Associate professor of marketing

California State College, Long Beach

Journal of Marketing

April 1970

(Provided by Jonathan Bean, PhD, Professor of History, Southern Illinois University, May 2024)

“The relatively clinical but nonetheless alarming data in the Surgeon General’s report were accompanied by an increase in high fear anti-cigarette propaganda. On a busy parkway in Connecticut a prominent sign read. ‘Are you dying for a smoke?’ One prankster even ripped down an advertising sign reading ‘This is Marlboro Country’ and placed it over the gates of a cemetery. Nonetheless, millions of Americans continue to smoke. The overall cigarette consumption did drop by 1.3 billion cigarettes during 1968. This figure loses its significance when it is compared to the volume of cigarettes smoked that year … 526.5 billion. The drop was approximately two tenths of 0ne percent. Truly, if men were ‘rational,’ consumption would have dropped far more dramatically or perhaps would have disappeared altogether.

“Sometimes scare data result in significant declines in consumption of some products. In the early 1960s, two women died after eating a can of spoiled tuna. Almost immediately tuna consumption dropped to extremely low levels. Thousands of tuna fishermen and canners were laid off. Ironically, the objective danger of eating spoiled tuna was small in comparison to the risk entertained by the cigarette smoker. The famous cancer-cranberry scare of the late 1950s almost destroyed the cranberry industry, to cite another example.

“The point is that easy substitutions exist for tuna or cranberries. More importantly, one does not find the addiction to either product that characterizes many smokers’ commitment to cigarettes. Had only one brand of cigarettes been suspected of being carcinogenic, it can be assumed that its demand would drop to zero as its former buyers quickly switched to other brands. However, as cigarettes were indicted as a class, no such easy substitution was available…”

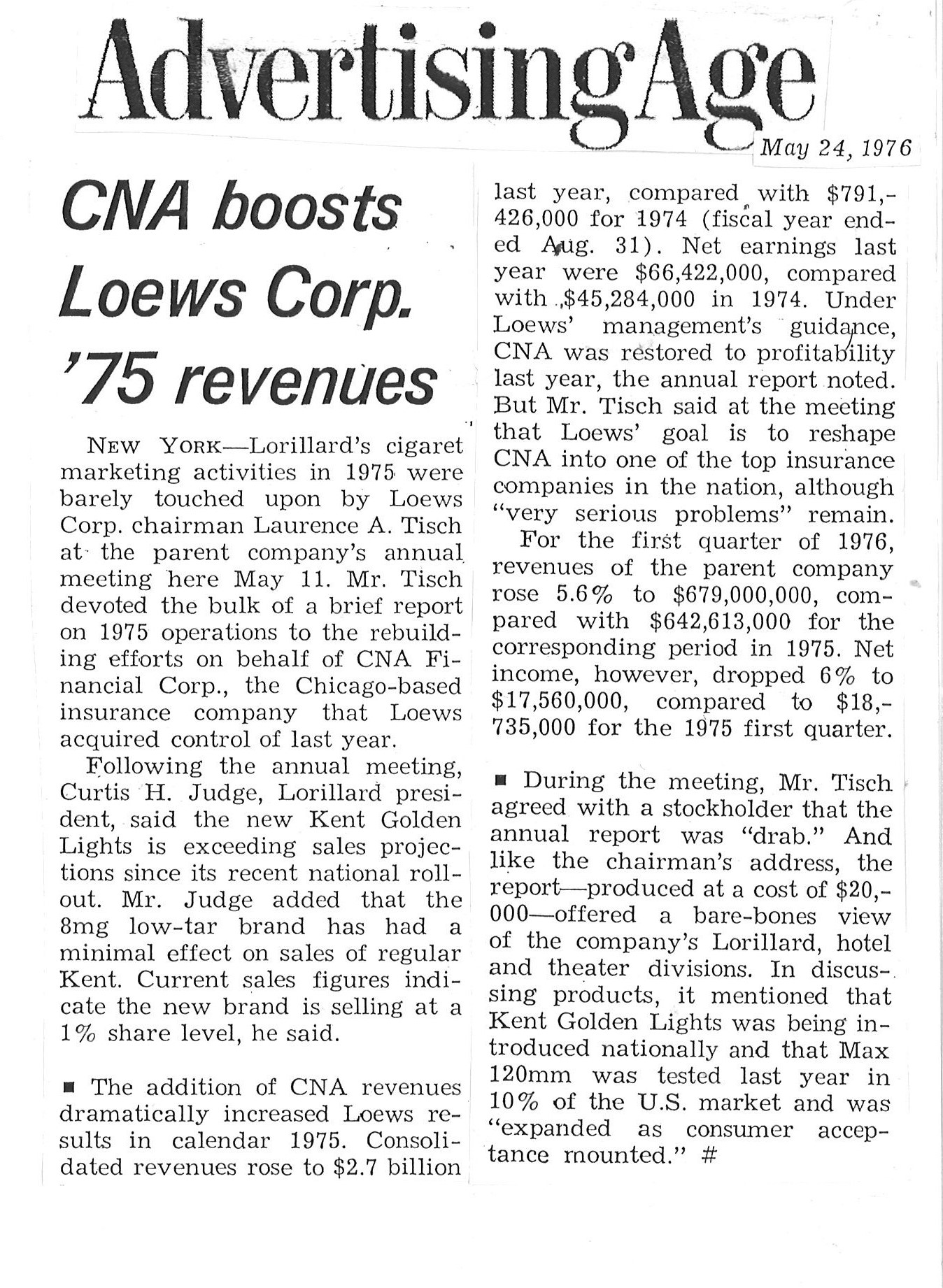

When Allstate scared the health out of Philip Morris

In July 1979, fully 15 years after State Mutual Life Assurance Company of America debuted the first magazine advertisements for a non-smoker’s discount on life insurance, Leo Burnett, the advertising agency for Philip Morris’s Marlboro and Virginia Slims cigarettes, alerted the tobacco company about plans by another of its clients, Allstate Life Insurance Company, to launch a nationwide TV and print media advertising campaign for its new non-smoker’s discount. Although no fewer than 35 other life insurers were now offering such policies, Philip Morris urged The Tobacco Institute and other cigarette companies to join an effort to dissuade Allstate from moving forward with the campaign. But the company did not back down.

“Q. Can you name the brand new life insurance policy that gives you 5% off just for being healthy?

A. Allstate’s Healthy America Plan.”

Layout by the Leo Burnett Company, Inc. advertising agency of a print advertisement for client Allstate Life Insurance Company

1979

(page 3 of a 6-page TV and magazine advertising campaign plan for the Leo Burnett advertising agency client Allstate Life Insurance Company sent by Leo Burnett to another client, Philip Morris Incorporated, and forwarded by James C. Bowling, Senior Vice President and Assistant to the Chairman of the Board, to William Kloepfer, Jr., Senior Vice President, The Tobacco Institute, Inc., on July 12, 1979)

Source: Philip Morris Documents, Master Settlement Agreement Collection

Accessed in the Truth Tobacco Industry Documents

https://www.industrydocuments.ucsf.edu/docs/xhwv0184

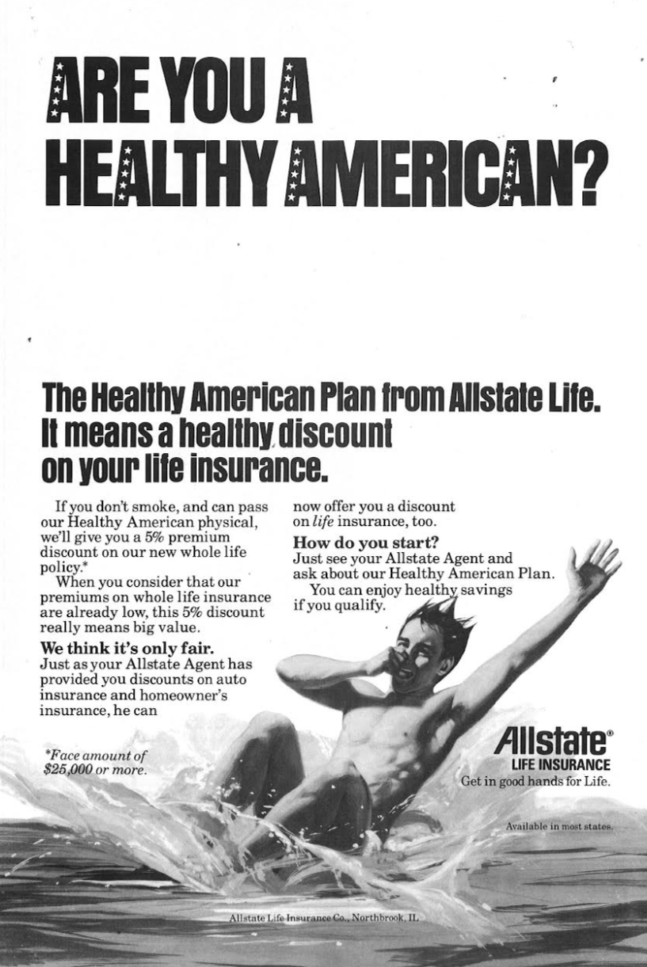

“ARE YOU A HEALTHY AMERICAN?

“The Healthy American Plan from Allstate Life.

“It means a healthy discount on your life insurance.

“If you don’t smoke, and can pass our Healthy American physical, we’ll give you a 5% premium discount on our new whole life policy…”

Advertisement by the Allstate Life Insurance Company

National Geographic Magazine

1979

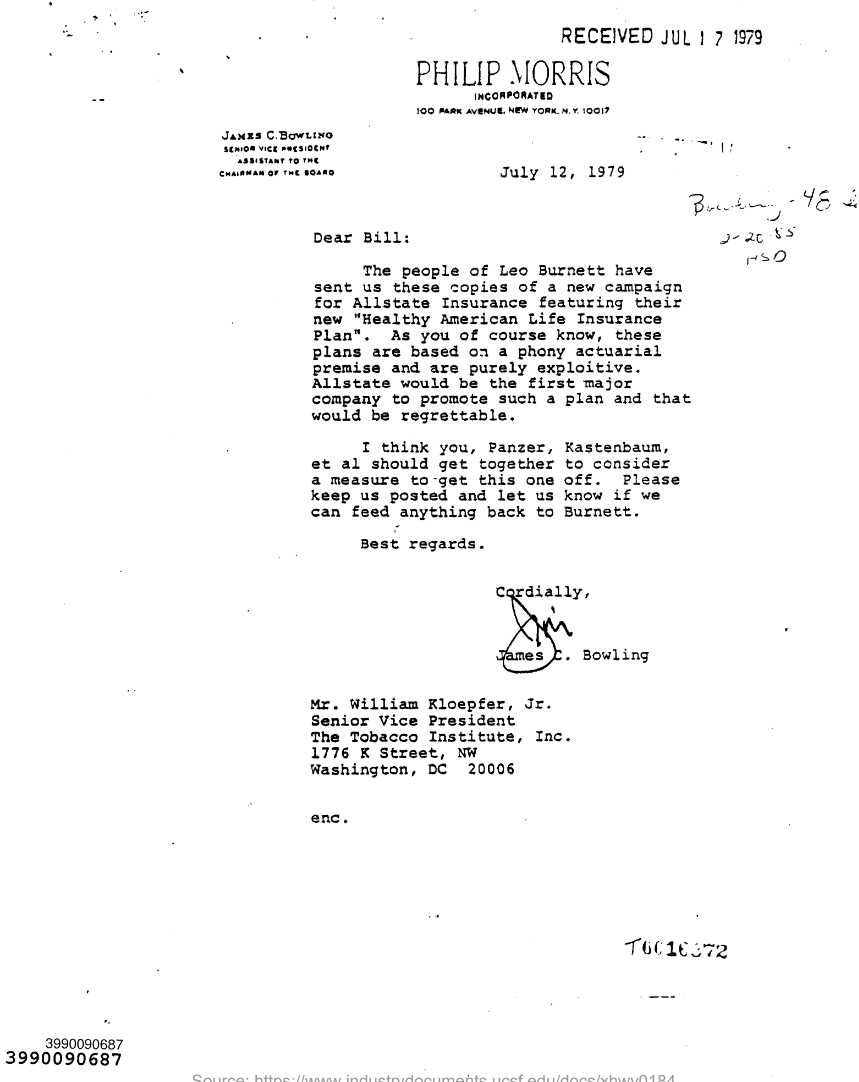

“Dear Bill:

“The people of Leo Burnett have sent us these copies of a new campaign for Allstate Insurance featuring their new “Healthy American Life Insurance Plan”. As you of course know, these plans are based on a phony actuarial premise and are purely exploitive. Allstate would be the first major company to promote such a plan and that would be regrettable.

“I think you, Panzer, Kastenbaum, et al should get together to consider a measure to get this one off. Please keep us posted and let us know if we can feed anything back to Burnett.

“Best regards…” (7 pages)

Letter from James C. Bowling, Senior Vice President and Assistant to the Chairman of the Board, Philip Morris Incorporated to William Kloepfer, Jr., Senior Vice President, The Tobacco Institute, Inc., with attachment consisting of the storyboards of the planned TV commercial for the Allstate Life Insurance Company’s Health American non-smoker’s discount, along with the layout for a print advertisement in the campaign.

July 12, 1979

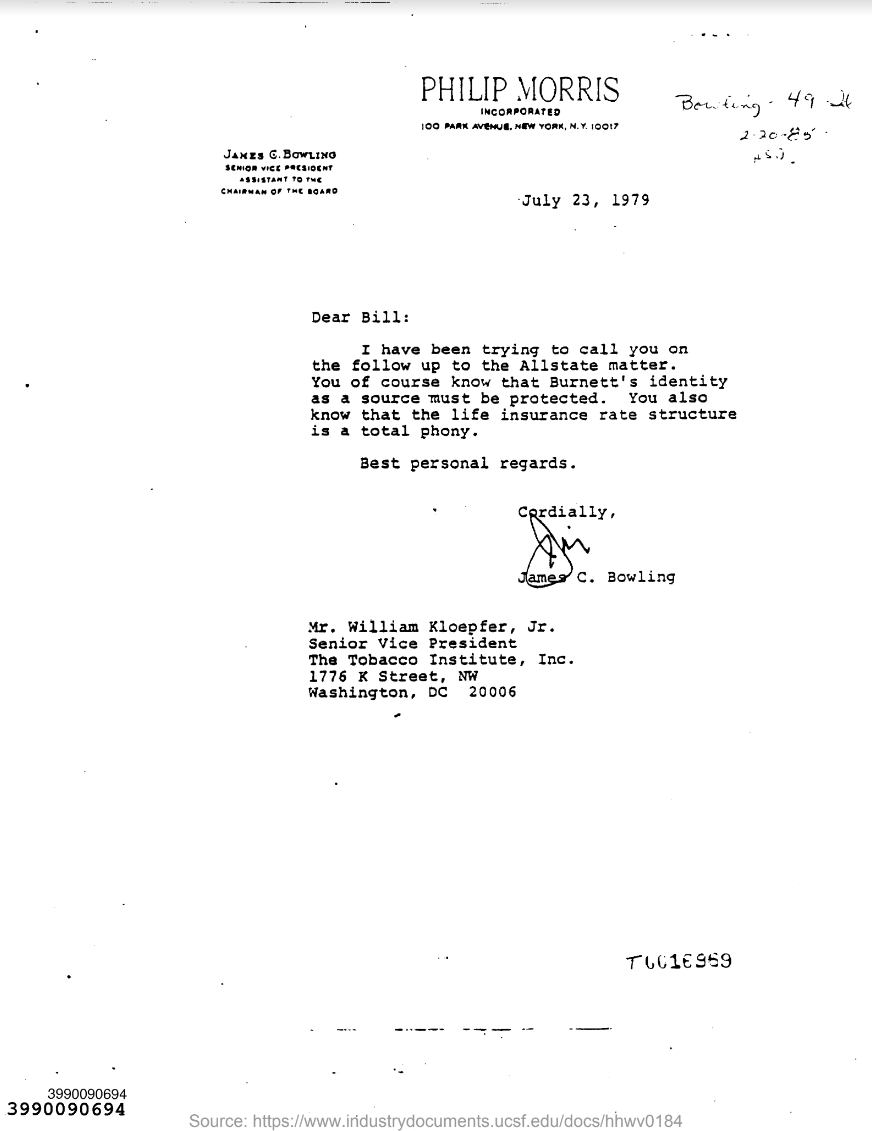

“I have been trying to call you on the follow up to the Allstate matter. You of course know that Burnett’s identity as a source must be protected. You also know that the life insurance rate structure is a total phony…”

Letter from James C. Bowling, Senior Vice President, Assistant to the Chairman of the Board, Philip Morris Incorporated, to William Kloepfer, Jr., Senior Vice President, The Tobacco Institute, Inc.

July 23, 1979

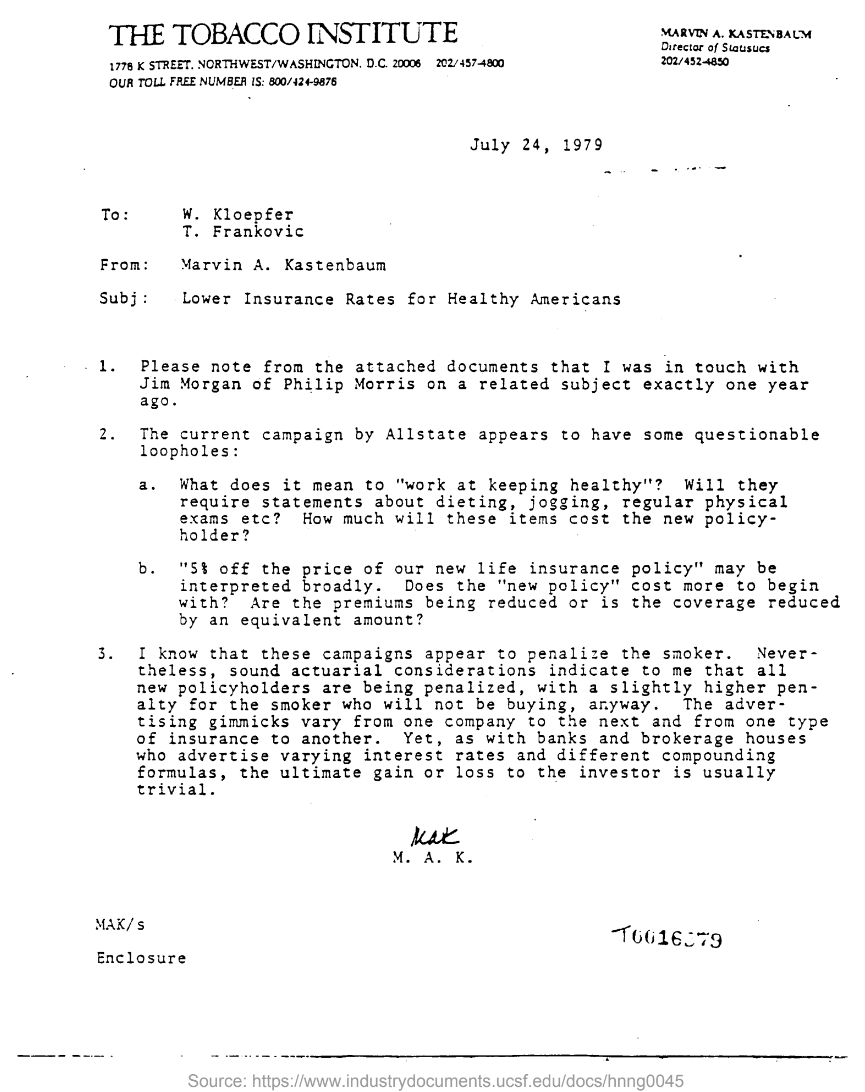

“…I know that these campaigns appear to penalize the smoker. Nevertheless, sound actuarial considerations indicate to me that all new policy holders are being penalized, with a slightly higher penalty for the smoker who will not be buying, anyway. The advertising gimmicks vary from one company to the next and from one type of insurance to another. Yet, as with banks and brokerage houses who advertise varying interest rates and different compounding formulas, the ultimate gain or loss to the investor is usually trivial.”

Memorandum, “Lower Insurance rates for Healthy Americans,” from Marvin A. Kastenbaum, Director of Statistics, The Tobacco Institute, to W. Kloepfer and T. Frankovic

July 24, 1979

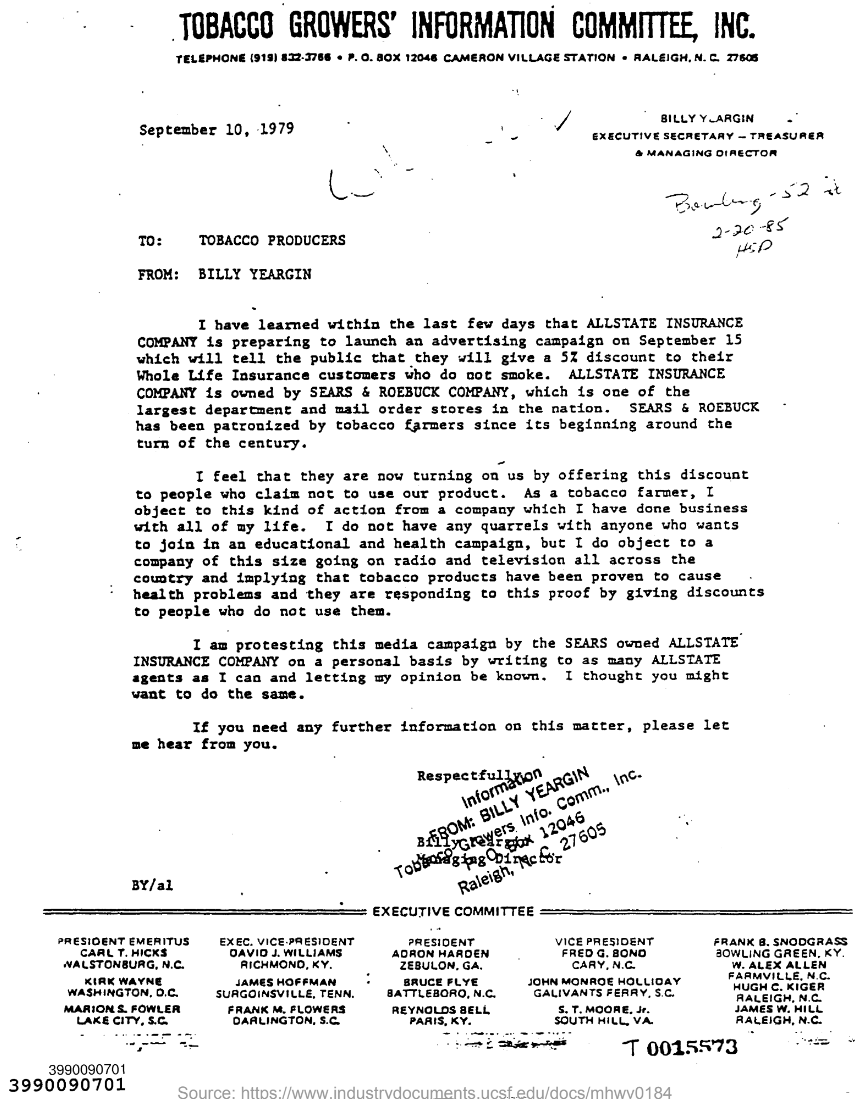

“ALLSTATE INSURANCE COMPANY is owned by SEARS & ROEBUCK COMPANY, which is one of the largest department and mail order stores in the nation. SEARS & ROEBUCK has been patronized by tobacco growers since its beginning around the turn of the century.

“I feel that they are now turning on us by offering this discount to people who claim not to use our product. As a tobacco farmer, I object to this kin] of action from a company which I have done business with all of my life…

“I am protesting this media campaign by the SEARS owned ALLSTATE INSURANCE COMPANY on a personal basis by writing to as many ALLSTATE agents as I can and letting my opinion be known. I thought you might want to do the same…”

Letter from Billy Yeargin, Executive Secretary-Treasurer & Managing Director, Tobacco Growers’ Information Committee, Inc. to tobacco producers

September 10, 1979

“Dear Mr. Kornegay:

It was a pleasure meeting with you and Messrs. Cook, Henderson, Panza and Mills last Thursday to discuss Allstate Life’s Healthy American Plan advertising campaign. We understand your interest in our non-smokers’ discount and hope that, having viewed a rough-cut of our TV commercial, you will agree it is not an attack on tobacco and does not really constitute a threat to your industry. The mere presence of the four words ‘because I don’t smoke’ in a thirty-second commercial can hardly constitute an attack on tobacco…” (2 pages)

Letter from Robert S. Seiler, Senior Vice President, Secretary and General Counsel, Allstate Life Insurance Company to Horace R. Kornegay, President, Tobacco Institute

September 10, 1979

Informational packet provided to the insurance commissioner of Kentucky by Allstate Life insurance Company about its non-smokers’ discount for personal life insurance, forwarded as an attachment to a memorandum sent by attorney David N. Henderson of the law office Cook & Henderson to executives of The Tobacco Institute, September 12, 1979. (10 pages)

“Companies That Offer Preferred Premiums for Non-Smokers

“Acacia Mutual, Aetna Life, American National, Berkshire Life, Colonial Life, Columbian Life, Confederation Life, Connecticut Mutual, Farmers New World, Farmers Traders, Gulf Life, Home Life, Indianapolis Life, Jefferson Standard, Kentucky Central, Lincoln National, Manhattan Life, Mutual of New York, Mutual Security Life, National Fidelity Life, National Home Life, National Life (Vt.), New England Mutual, Occidental (N.C.), Ohio State Life, Pacific Mutual, Paul Revere Life, Phoenix Mutual, Pilot Life, St. Paul Life, Security Mutual (N.Y.), State Mutual of America, Travelers, Union Central, Unity Mutual”

(The Metropolitan Life Insurance Company is not listed among the 35 companies offering a non-smoker’s discount)

ALLSTATE LIFE INSURANCE COMPANY Non-Smokers’ Discount

Listed below are some items that were considered in the process of adopting a non-smokers’ discount for our personal life insurance:

1. The Framingham Study indicated the probability of dying from cardiovascular-renal (CVR) diseases or cancer was much higher for smokers than it was for non-smokers. Furthermore, those that smoked more than one pack of cigarettes per day had a greater probability of dying from CVR disease or cancer than those who smoked less than a pack a day;

2. Numerous other studies, such as the Albany Cardiovascular Health Center Study, the Chicago People’s Gas Company Study, the Chicago Western Electric Company Study, and the Tecumseh Study, also substantiate a higher mortality rate for cigarette smokers than non-smokers;

3. Allstate Life Insurance Company’s statistics indicate that a high proportion of the deaths of those insured by our personal life insurance policies result from CVR disease and cancer…);

4. The Surgeon General’s Office, over the past 15 years, has issued several reports which concluded cigarette smoking may be dangerous to a person’s health;

5. During this past year, the former Secretary of HEW, Joseph Califano, wrote Allstate Life Insurance Company (and, we believe, most major life insurance companies) inquiring whether-or not we recognized the lower mortality rate of non-smokers in our pricing structure of personal life insurance;

6. In 1964, State Mutual Life Insurance Company became the first major life insurer to offer a reduced rate on life insurance for those people who did not smoke cigarettes. State Mutual has indicated that its experience over the past fifteen years demonstrates better mortality for those individuals who qualify for their non-smokers’ discount. However, State Mutual considers its statistics on the savings in mortality to be of proprietary interest and has not released this data to the rest of the insurance industry;

7. Other life insurance companies have followed State Mutual in offering non-smokers1 discounts for personal life insurance …, We have compiled this information from various published sources, but we do not know for certain whether or not these companies offer the non-smokers’ discount in all states in which they are licensed,, To our knowledge, none of these companies have released their mortality experience;

8. There is much objective evidence available that clearly shows non-smokers will, on average, live longer than smokers. There is, however, a dearth of statistics on insured lives. We don’t know how many of our new insureds are nonsmokers and we also don’t know in dollars and cents the exact amount the premium should be reduced for non-smokers as compared to smokers, Because of these unknowns, we have initially limited our discount to one plan of insurance. As our experience develops, we may expand the discount to other plans or eliminate it on this initial plan.

This 2-page summary by Paul J. Overberg, Senior Vice President and Chief Actuary, Allstate Life Insurance Company, is included in a 10-page memorandum sent by attorney David N. Henderson of the law office Cook & Henderson to executives of The Tobacco Institute, September 12, 1979.This 2-page summary by Paul J. Overberg, Senior Vice President and Chief Actuary, Allstate Life Insurance Company, is included in a 10-page memorandum sent by attorney David N. Henderson of the law office Cook & Henderson to executives of The Tobacco Institute, September 12, 1979.

“ALLSTATE LIFE’S HEALTHY ACTION PLAN” (5 pages)

Standby press release by Allstate Life Insurance Company announcing its Healthy American Plan life insurance policy, with an appendix listing the statistical studies on which it is based

September 1979

“Called the Healthy American Plan, the policy provides two premium discounts, one for people who don’t smoke cigarettes and another for non-smokers who can pass a required physical examination.

“Those who are 21 through 75 years of age who don’t smoke cigarettes or who haven’t smoked in the past 12 months are eligible for a discount.

“Written certification that a prospective insured has not smoked cigarettes for a year is all that is needed for approximately a 3 percent discount depending on age. Insured are not disqualified if smoke pipes or cigars.

“Non-smokers may qualify for an additional ‘good health’ discount of approximately 2 percent if their medical history and other findings of a required medial exam are acceptable…

“If asked is Allstate plans to proceed with the policy, despite criticism from the tobacco industry: Allstate feels such criticism is contrary to the Tobacco Institute’s own philosophy about smoking and non-smoking, which is made apparent in the Institute’s two-page advertisements that have appeared in several national magazines.

“In the context of those advertisements, entitled ‘A word to smokers’ and ‘A word to non-smokers,’ Allstate Life’s campaign can hardly be said to be ‘anti-smoking’ or ‘anti-smokers.’

The tobacco Institute’s advertisements make the point hat smokers and non-smokers must make sensible accommodations to one another, and that ‘freedom of choice is the best choice.’ Thus, any criticism of the discount by those in the tobacco industry is completely contradictory to the institute’s own advertisements. Such criticism of the Healthy American Plan may well be viewed by non-smokers as an effort to deprive them of the benefits of their own choice not to smoke. That would hardly fit the slogan ‘freedom of choice is the best choice.’..”

“As you know, the Tobacco Growers Information Committee has mounted a campaign protesting Allstate’s introduction of a non-smoker discount on life insurance and are seeking to have us discontinue advertisements of that plan. The campaign has spread to include Sears…

“As one businessman to another, we can understand your concern for the future of your industry and the potential impact on the thousands of people engaged in some facet of the tobacco industry. We hope you will take a broader view of Allstate Life’s action than that taken by the Tobacco Growers Information Committee.

“…May we respectfully request that you review this situation in light of the facts and as objectively as possible. Having done so, we ask that you use your considerable influence with the Committee to convince them to cease their actions against Allstate and Sears out of self-interest, if for no other reason…” (2 pages)

Letter from Robert S. Seiler, Senior Vice President, Secretary and General Counsel, Allstate Life Insurance Company to Clifford H. Goldsmith, President, Philip Morris Corporation

September 20, 1979

“Philip Morris has been thoroughly familiar with the alleged ‘facts’ behind this type of promotion of the sale of life insurance for more than a decade. We only regret that a company of the stature of Sears now finds it necessary to adopt such questionable techniques.” (3rd page)

Reply from Thomas F. Ahrensfeld, Senior Vice President and General Counsel, Philip Morris Incorporated

September 25, 1979